American Airlines had a tumultuous year, with the airline eking out a small quarterly profit at the end of 2025. However, one item among its operating expenses rose faster than the rest: distribution costs.

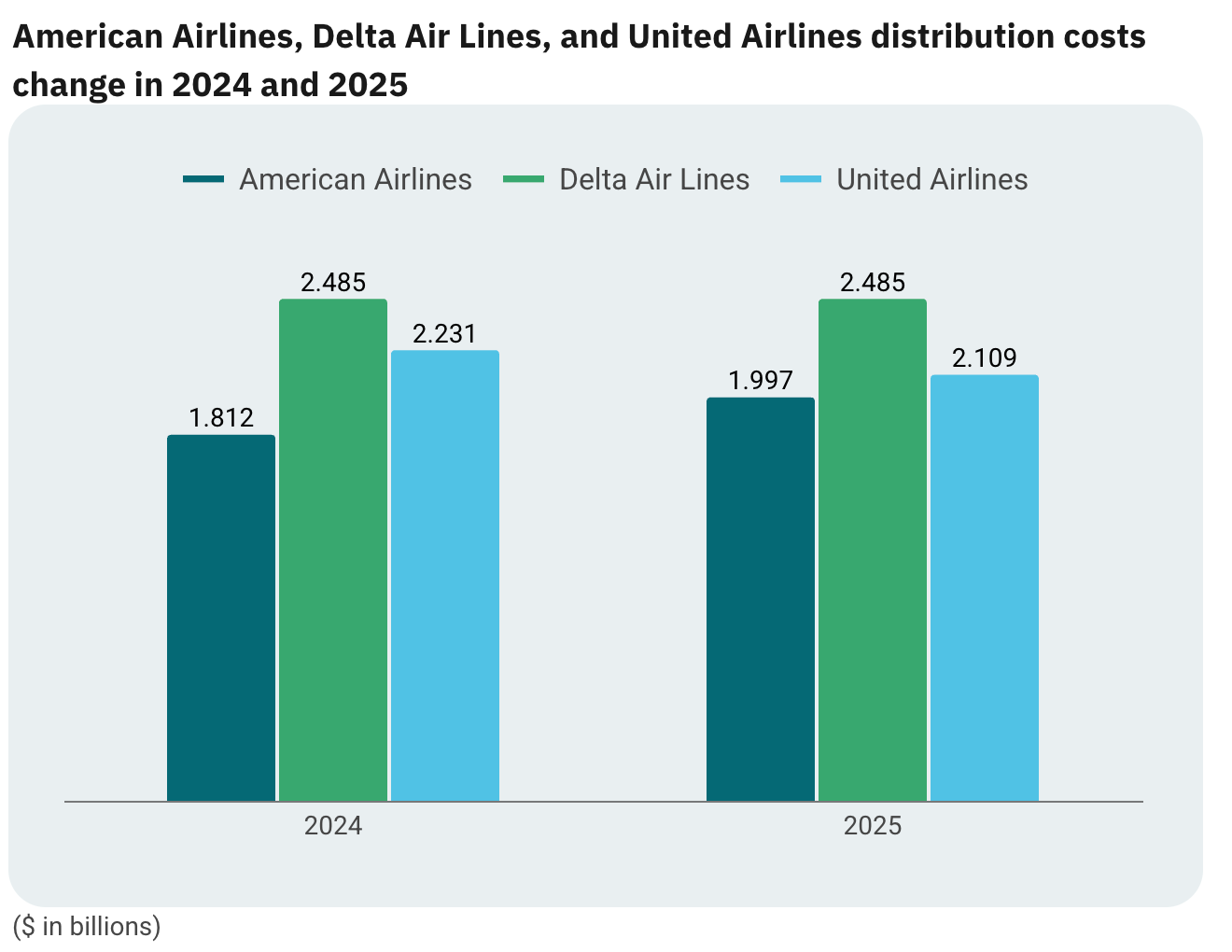

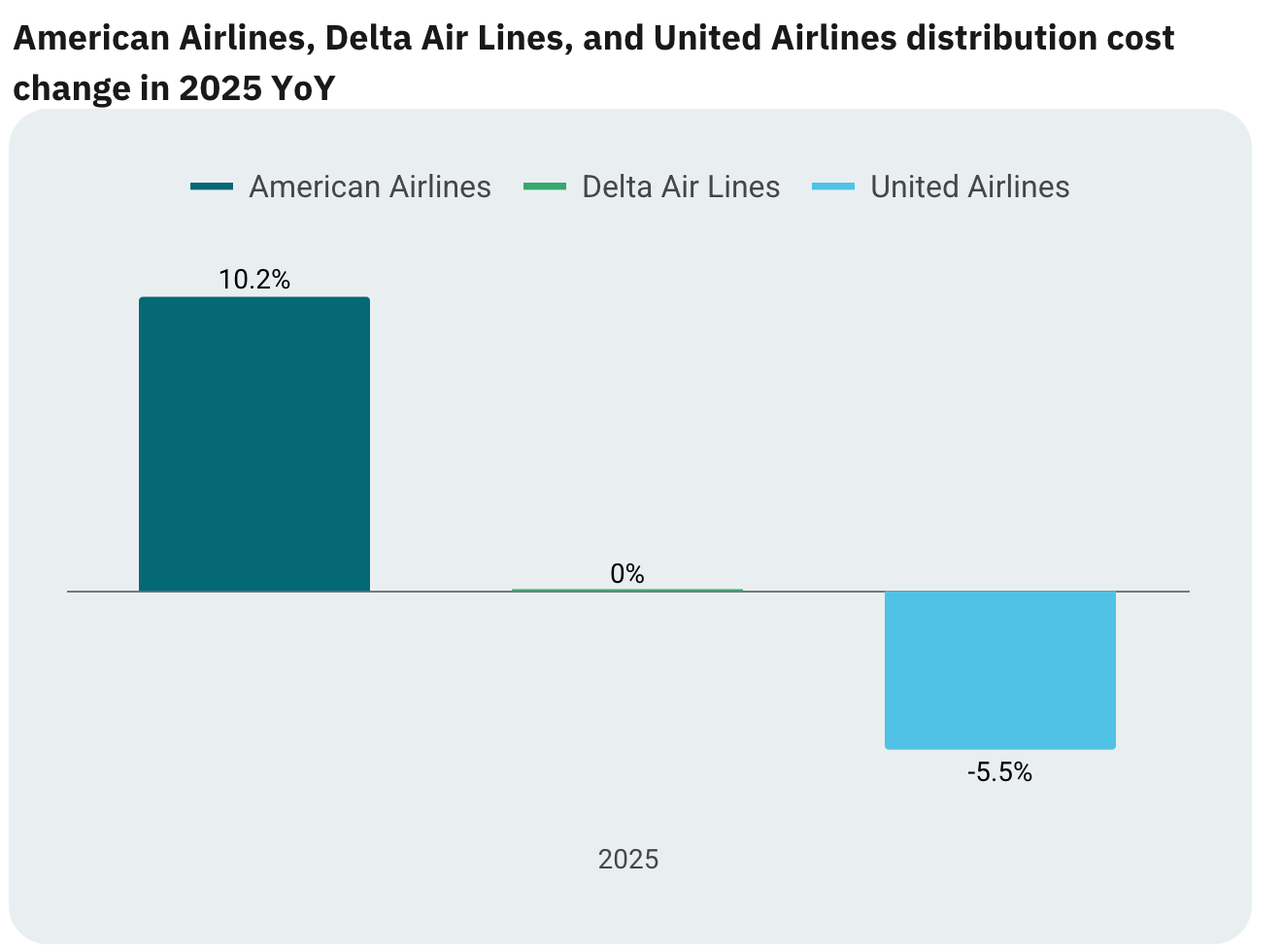

During the quarter – and the year – American Airlines’ distribution costs, accounted as ‘selling expenses,’ rose around 10% year-on-year (YoY). In comparison, Delta Air Lines’ quarterly and yearly passenger commissions and other selling expenses were 1% lower in Q4 and flat YoY, while United Airlines’ were 3.5% higher in Q4 and 5.5% lower YoY.

Distribution spend

Despite the YoY increase, the quarterly sum spent on distributing tickets was the lowest out of the top three full-service airlines in the United States, with American Airlines spending $529 million to distribute tickets in Q4 2025. Delta Air Lines and United Airlines’ spending was $616 million and $571 million, respectively.

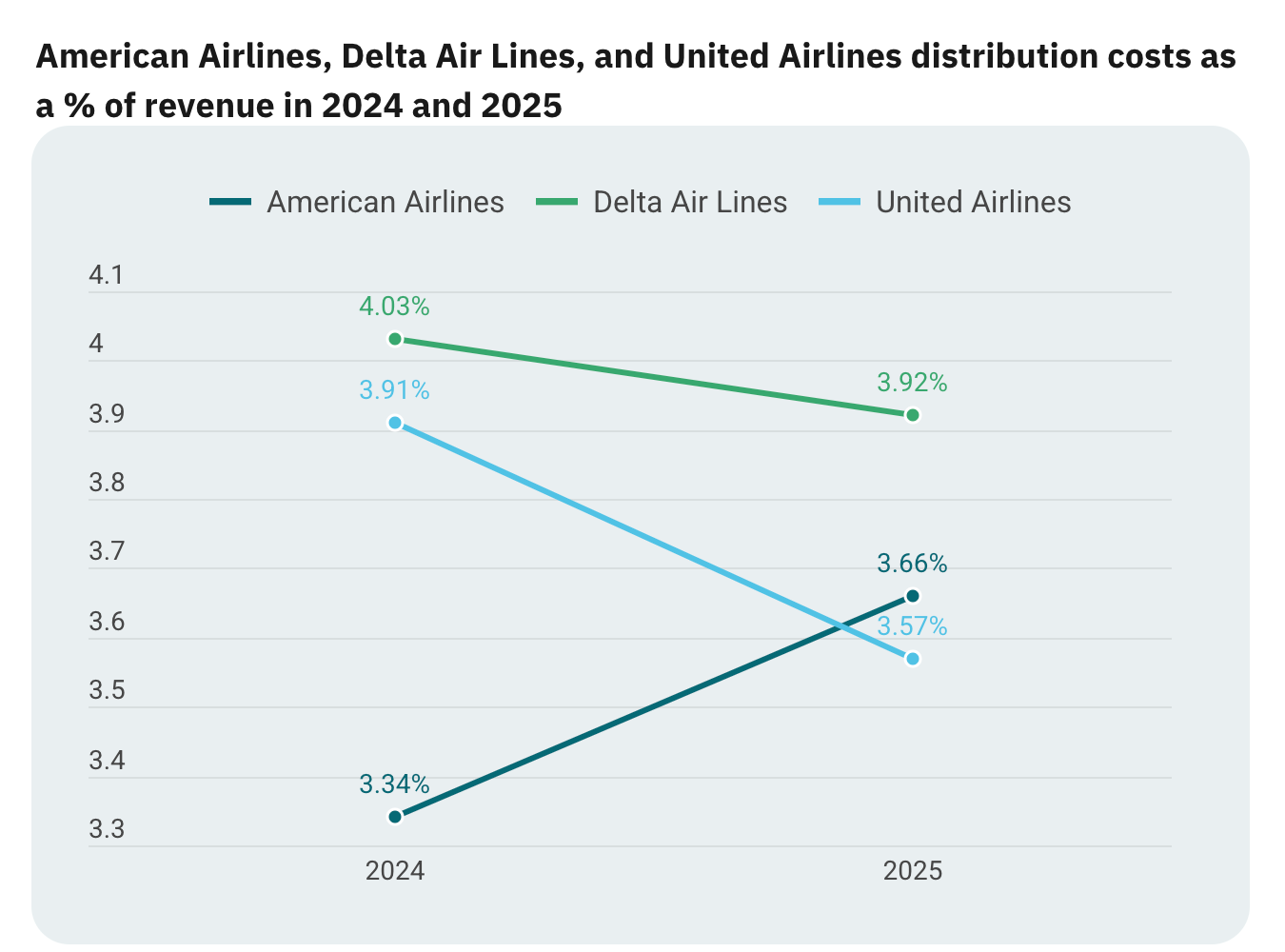

Distribution costs were 3.6% of American Airlines’ revenue, 3.9% of Delta Air Lines’ revenue, and 3.5% of United Airlines’ revenue in 2025. In 2024, the split was 3.3%, 4%, and 3.9%, analysis of the trio’s financial results showed.

American Airlines was the only one of the three airlines to see distribution expenses rise as a proportion of revenue in 2025 compared to 2024.

Cory Garner, the Chief Executive Officer (CEO) of Garner, an airline distribution advisory firm, and a former senior executive at American Airlines, said the carrier’s revenue per available seat mile (RASM) “performance continues to lag its primary competitors year-over-year [YoY], despite it regaining some corporate market share,” potentially suggesting that incremental revenue from “corporate is being offset by revenue losses and/or displacement in other market segments.”

During the carrier’s Q4 2025 earnings call, Robert Isom, the CEO of American Airlines, said that the company “fully restored our historical sales and distribution indirect share” and that its focus was now further growing that share in 2026 and beyond.

“As we move into 2026, we will continue to deepen the relationships that we have built with our corporate and agency partners, and capture a greater share among high-value corporate travelers and premium leisure customers.”

Garner was a bit more skeptical, noting that it “appears they are gaining back some corporate share, but it is not clearly generating incremental bookings or yield overall.”

‘Too much change too fast’

Garner pointed out that American Airlines began changing its distribution strategy, travel management company (TMC) commissions, and corporate discounts in 2023. The strategy eventually backfired, resulting in Vasu Raja, the then-Chief Commercial Officer (CCO) of American Airlines, leaving the company in June 2024.

Nevertheless, Garner believes that there was “too much change too fast,” and that the strategic changes might have been more effective if they were implemented in stages. Still, the executive highlighted that American Airlines has always been transparent about its efforts to renegotiate TMC deals, and that “we have seen the cost impact of higher TMC commissions over that entire time period.”

Garner concluded that “we are getting closer to lapping the effects of those cost increases on a [YoY] basis.”