Chicago O’Hare International Airport (ORD) has been at the forefront of an intense capacity war between two airlines that consider the airport their hub, American Airlines and United Airlines. While the carriers are pursuing different goals – with United Airlines looking to cement its leading position at the airport and American Airlines aiming to claw back its market share – both will add significant capacity at ORD this year. Even before the recent tit-for-tat announcements on overlapping routes, the pair had plenty of overlap at the airport.

The Engine Cowl, using Department of Transportation (DOT) data compiled by Cirium’s Diio Mi, looks at the two airlines’ overlapping domestic routes at ORD between November 2024 and October 2025, and those routes’ load factors. Seasonal routes, or itineraries with only a month or two overlap, were not used in the comparison.

Hub advantages

Cirium’s Diio Mi shows that, of the 81 overlapping routes operated between November 2024 and October 2025, American Airlines held the load factor advantage on 37, while United Airlines held the edge on 36. On eight, the two airlines had identical load factors.

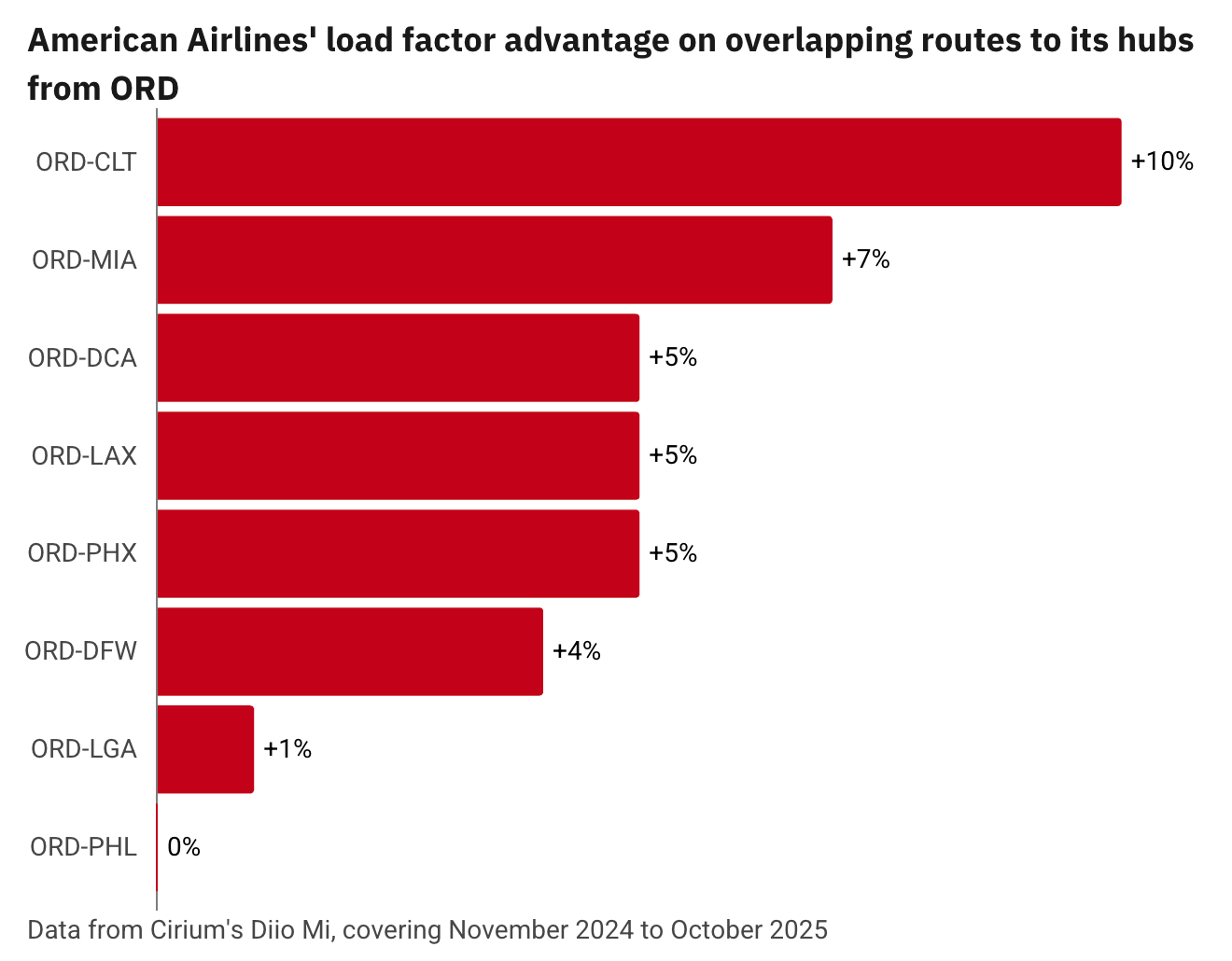

On the overlapping routes to American Airlines’ hubs, the airline had the load factor advantage on all but one route: ORD to Philadelphia International Airport (PHL), where the two airlines shared identical load factors.

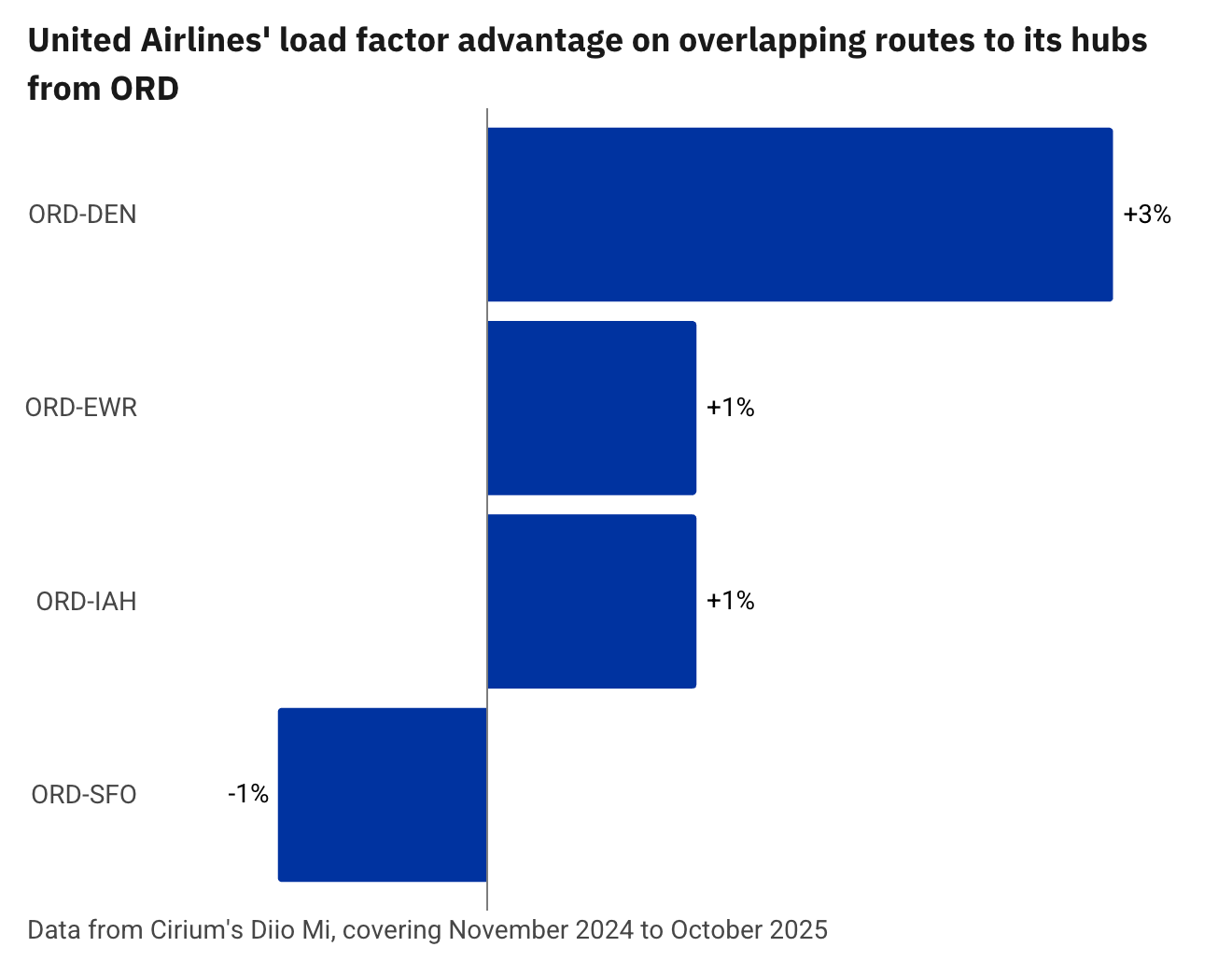

Meanwhile, United Airlines was ahead of American Airlines on its intra-hub routes from ORD on three out of four overlapping routes. The only route on which United Airlines had lower load factors was ORD to San Francisco International Airport (SFO).

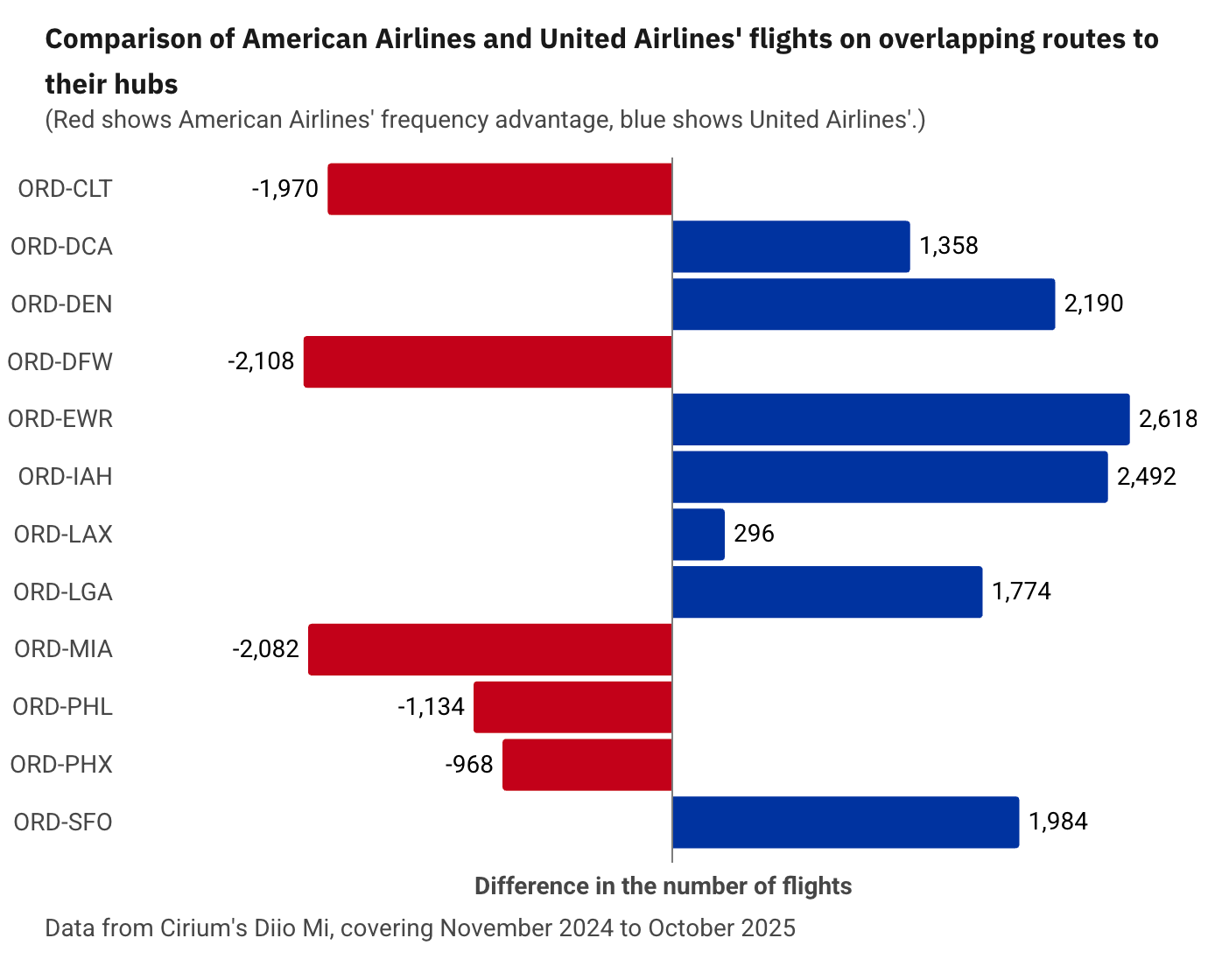

American Airlines offered more frequencies on five out of eight overlapping intra-hub routes. United Airlines scheduled more flights on all of its intra-hub flights out of ORD.

American Airlines’ firm advantage on its busiest ORD routes

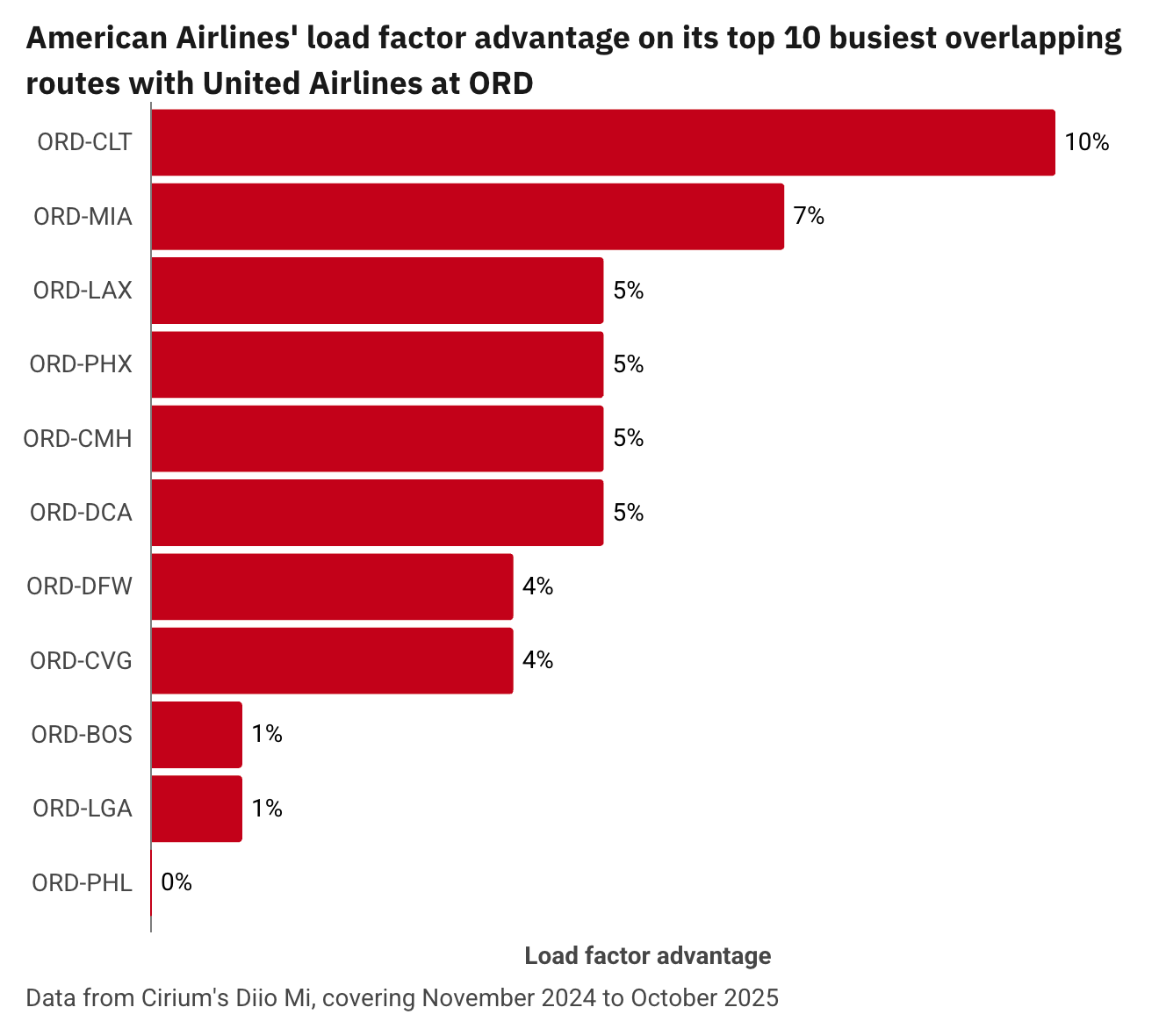

Looking at American Airlines’ 10 busiest routes during the 12-month period, the airline had a load factor advantage over its fiercest rival at ORD on nine, with ORD-PHL having been tied.

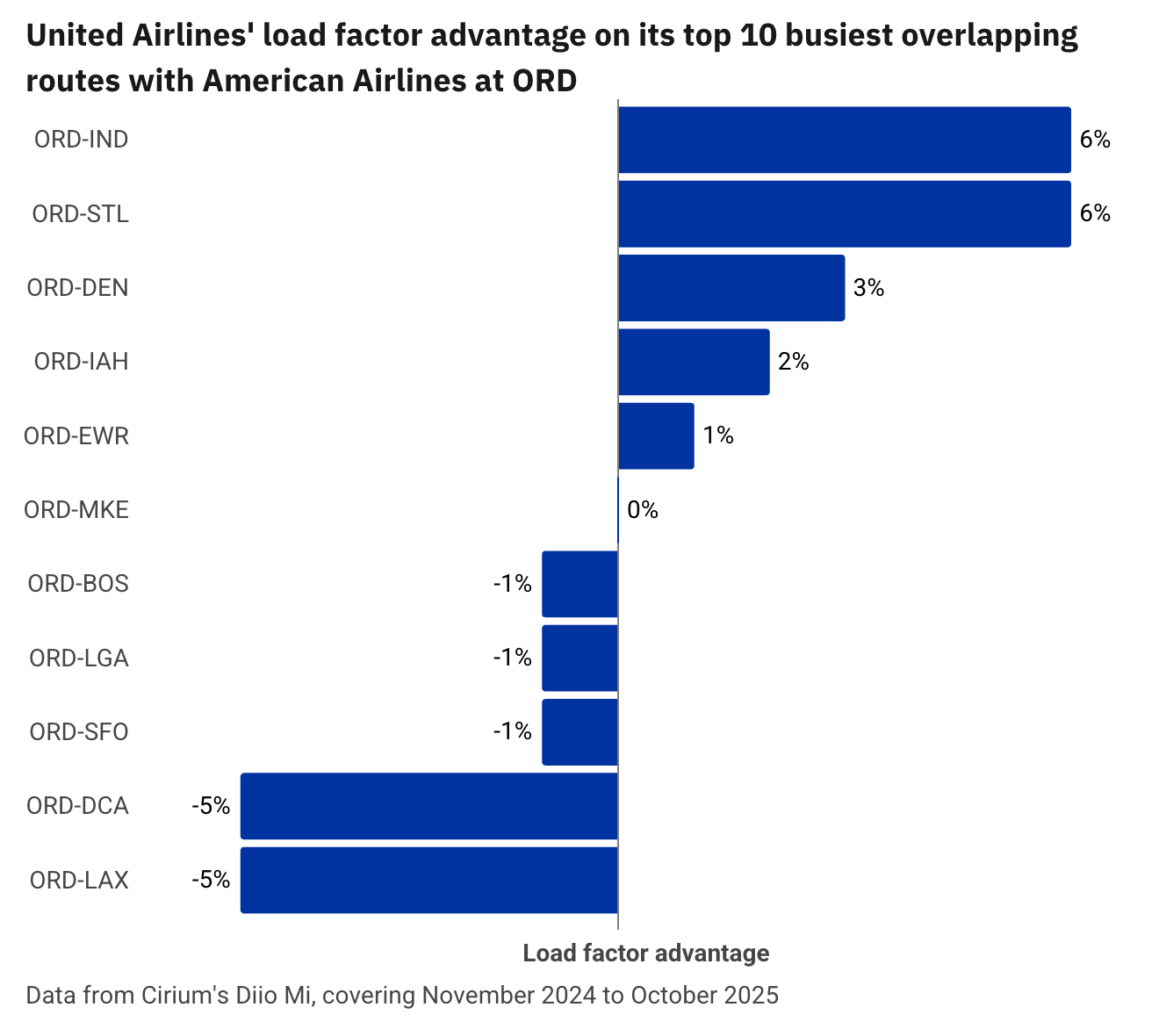

United Airlines, meanwhile, did not have that advantage. Out of its 10 busiest overlapping routes, United Airlines’ load factors were higher on only four routes, with the same load factor on one: ORD to Milwaukee Mitchell International Airport (MKE).

During the period, American Airlines generally achieved higher load factors on its 10 busiest routes from ORD. For United Airlines, the story was slightly different, with the airline’s frequency advantage not always translating into higher load factors. Case in point: ORD-Los Angeles International Airport (LAX), ORD-Washington Ronald Reagan National Airport (DCA), and three other routes.

Looking at the data for all 81 overlapping routes, there is a slightly positive correlation between frequency and load factor advantage. In other words, offering more flights than the competition is weakly associated with operating fuller flights, albeit far from a guarantee of doing so.

Nevertheless, higher load factors do not automatically mean that a flight is profitable, nor vice versa. After all, Scott Kirby, the Chief Executive Officer (CEO) of United Airlines, claimed that American Airlines was losing around $800 million a year at ORD in September 2025.

During United Airlines’ Q4 2025 earnings call on January 21, Kirby estimated that the competitor’s losses at the airport will deepen to around $1 billion in 2026. The chief executive also stated that United Airlines holds a significant 22% market share advantage in local Chicago traffic, and a 38% lead among brand-loyal customers.

United Airlines’ stage length-adjusted yield was approximately 11% higher than American Airlines in 2025, which suggests a significant revenue premium compared to its competitor (assuming mainline versus mainline stage length).

Given the revenue premium United Airlines achieved in 2025 compared to American Airlines, it is not surprising that American Airlines is facing an uphill battle at ORD. When your yields are lower, and you cannot systematically fill your cabins with more passengers than your competitor, it could spell trouble, or rather, steep losses.