Prior to the pandemic, the three capital cities of Budapest, Hungary, Prague, Czechia, and Vienna, Austria, were some of the more popular European destinations for tourists from East Asia, including China, Japan, South Korea, and Taiwan.

However, the recovery and growth of tourism flows from the four East Asian countries to the three cities have been uneven and shaped by geopolitical shifts within the governments. The Engine Cowl explores how the capacity between East Asia and Budapest, Prague, and Vienna has developed since the pandemic.

Budapest’s China focus

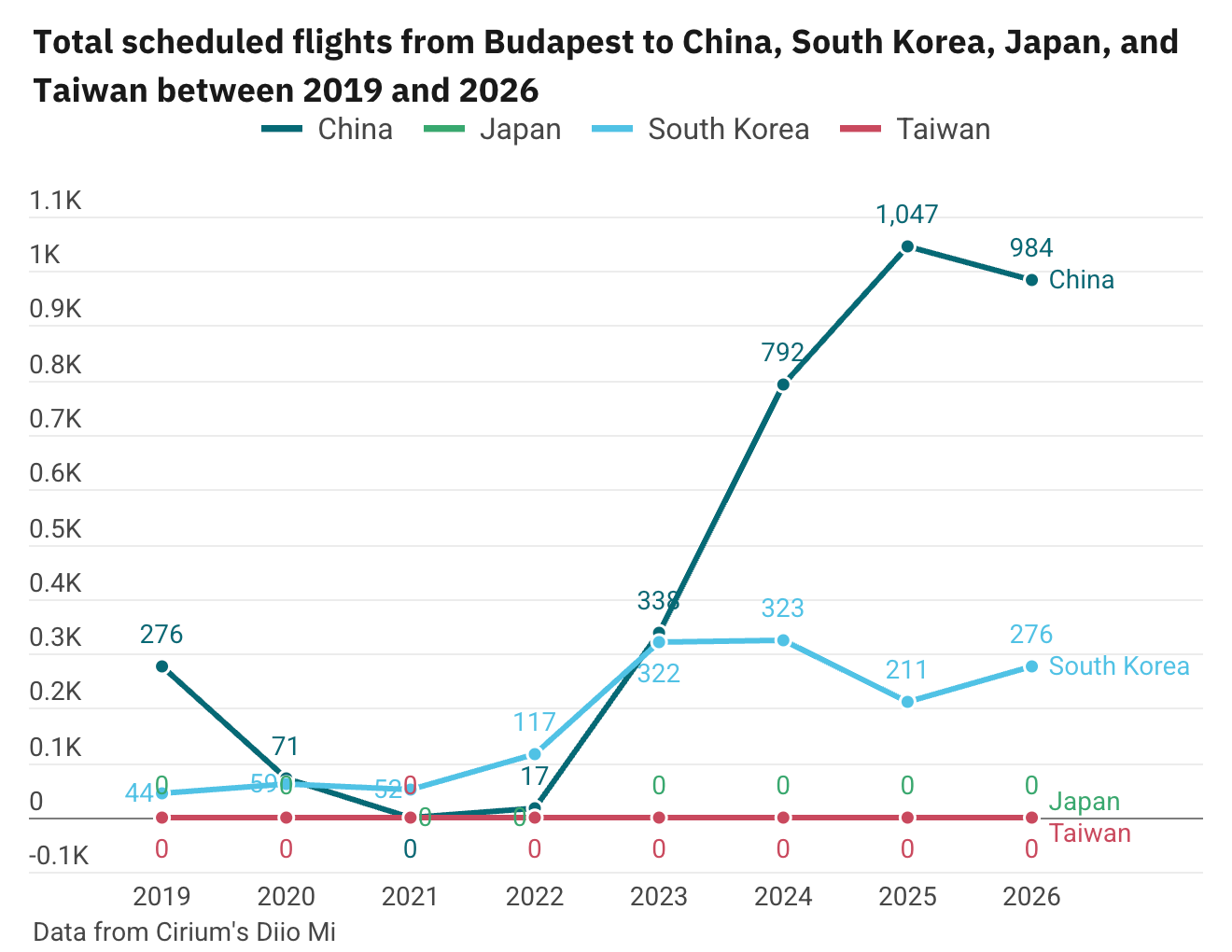

BUD has seen substantial capacity growth on flights to East Asia, in particular to China. Cirium’s Diio Mi shows that there are 984 flights scheduled between BUD and China in 2026, up from 276 in 2019. BUD’s network to China now includes seven destinations operated by four airlines: Air China, China Southern, Hainan Airlines, and Shanghai Airlines.

The market to South Korea has also grown, with annual flights increasing from 44 in 2019 to 276 in 2026. While LOT Polish Airlines no longer serves Seoul Incheon International Airport (ICN) from BUD, Asiana Airlines will join Korean Air on the BUD-ICN routes from April 2.

Still, the number of inbound visitors from China to Hungary is down from 279,000 to 248,381 between 2019 and 2025. Similarly, the number of visitors from South Korea is behind its pre-pandemic peak, 155,126 compared with 175,000 over the same period.

Prague’s connectivity to East Asia below pre-pandemic levels

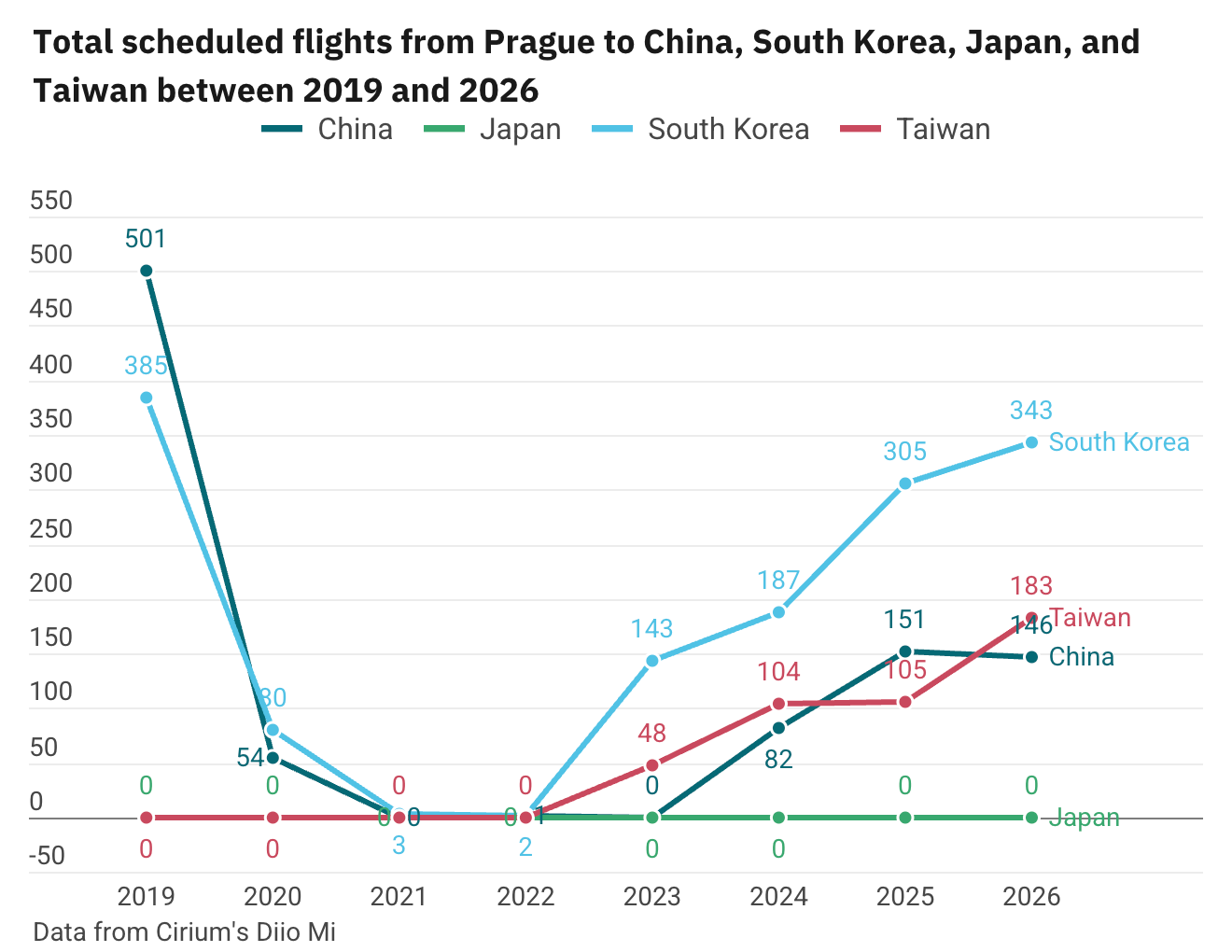

In contrast to BUD, PRG will offer 24% fewer flights to East Asia in 2026 than in 2019. China is the primary driver of the capacity reduction, with the market seeing a 71% fall in the number of flights for 2026 compared to 2019, while the number of Chinese tourists visiting Czechia has fallen by 66% from 2019 to 2025.

The market to South Korea is also below its 2019 levels, but has at least been recovering. Korean Air returned to PRG in March 2023, while Asiana Airlines began flying ICN-PRG on April 1, 2025.

Taiwan is the bright spot in the East Asia market for the airport. China Airlines launched direct flights to the Czech capital in July 2023, and STARLUX Airlines will launch its own TPE-PRG flights on August 1, bringing the total weekly frequency between PRG and TPE to six, growing to seven in October.

Austria-China connections

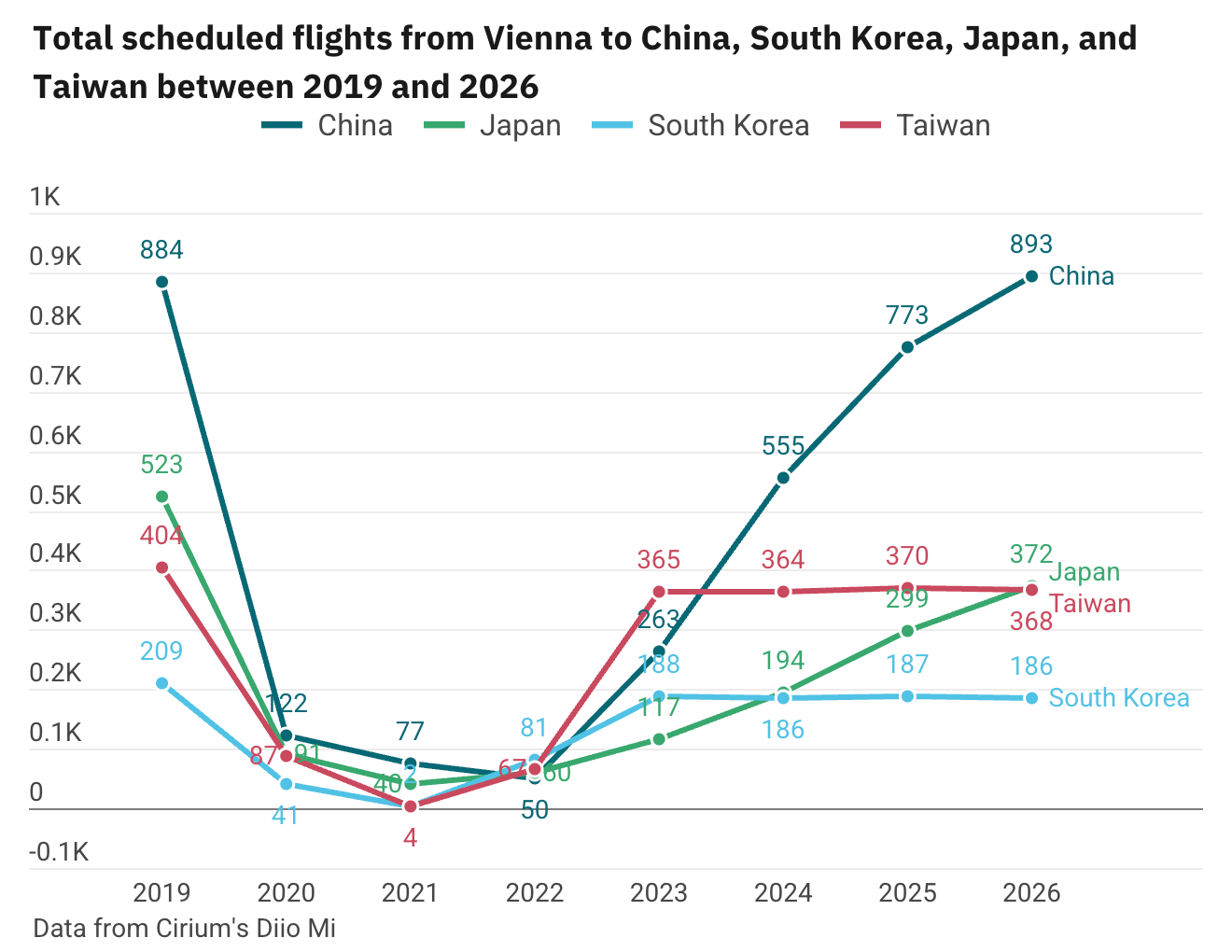

Before the pandemic, China was one of Austria's largest inbound tourism markets, ranking among the six countries with over 1 million visitors in 2019. While visitor inflows in 2025 were nowhere near pre-pandemic levels, over 431,000 Chinese nationals checked into stays in Austria, up 12% YoY, and there are slightly more Austria-China flights than before the pandemic.

The same could not be said about flights from Austria to Japan, South Korea, or Taiwan, all of which are below 2019 levels.

In 2025, 124,837 Japanese, 227,355 South Korean, and 154,618 Taiwanese nationals arrived at an accommodation in Austria. Out of the three, only Japanese visitor numbers grew by double-digits, according to Statistics Austria (Statistik Austria).

Overall, VIE’s total scheduled seats to East Asia are down 3% in 2026 versus 2019, as all but four airlines that flew from the Austrian capital to the region slashed capacity to the region, with some of them, including Austrian Airlines, also losing access to Russian airspace following Russia’s invasion of Ukraine in February 2022.

What all three countries have in common is that tourists from East Asia do not stay long. In Austria, the average stay for visitors from all four countries was 1.9 days, in Czechia, it was 2.87 days, while in Hungary, it was 2.2 days.

The close geographical proximity, as well as a developed rail network, allows visitors to travel between the two countries and make the most of their visits when they fly into Europe, including BUD, PRG, or VIE.