With fewer Canadians looking to visit the United States, and as the geopolitical tensions over trade are continuing to boil, Canadian airlines have begun the winter 2025/2026 season by adding more capacity and launching new flights south of the US.

For example, on October 27, 2025, Flair Airlines, the Canadian low-cost carrier, inaugurated its newest international routes, connecting Toronto Pearson International Airport (YYZ) and Vancouver International Airport (YVR) with Mexico City International Airport (MEX).

Maciej Wilk, the Chief Executive Officer (CEO) of Flair Airlines, said that making it easier for both countries’ residents to explore each other’s countries is “what affordable, modern aviation is supposed to do,” saying that the new routes, taking off from the two Canadian airports thrice weekly, are “a major win for our customers.”

(Air Canada and Aeroméxico have double-daily or daily flights on the routes, per Cirium’s Diio Mi.)

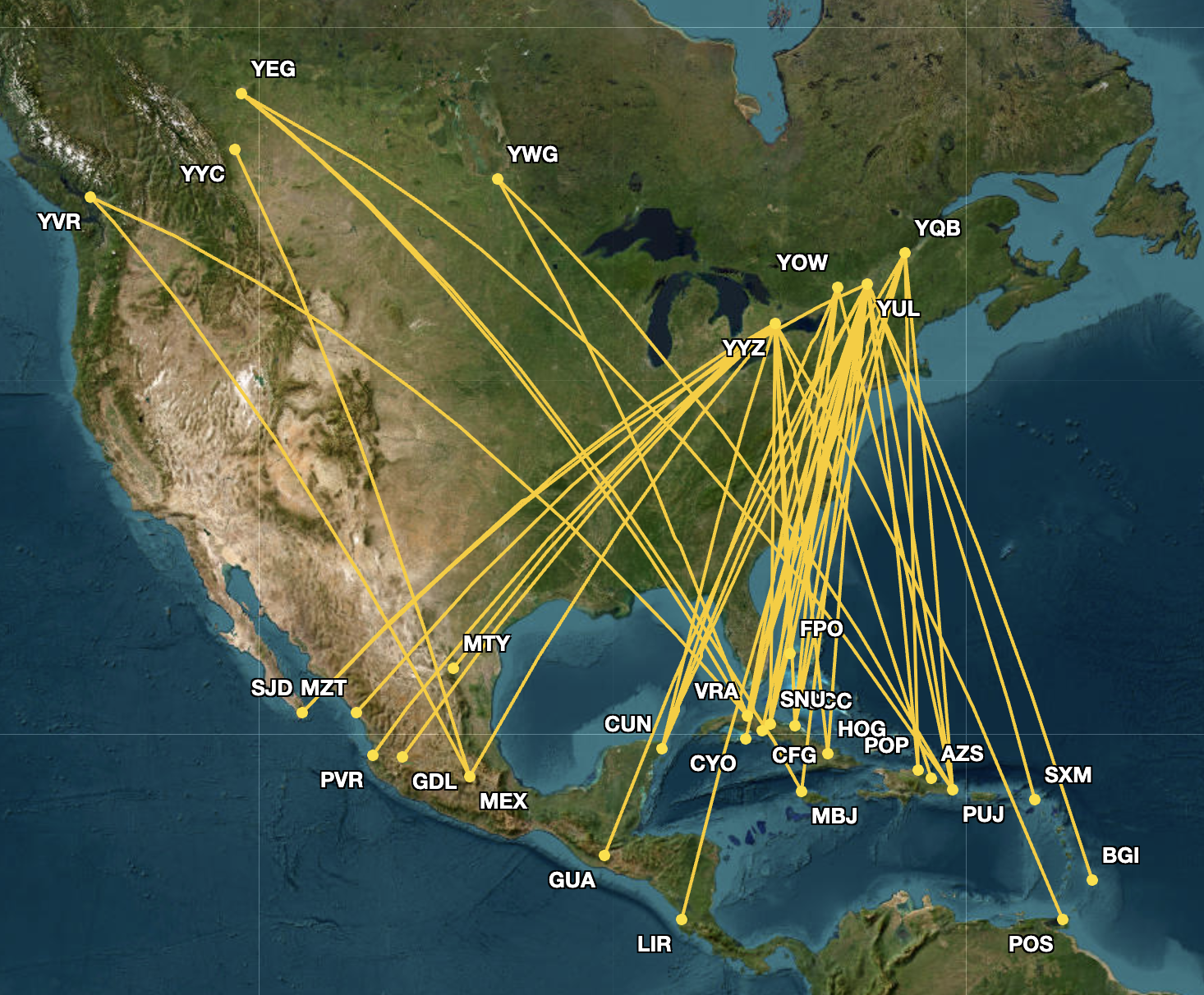

Flair Airlines is not the only Canadian carrier that has added new routes or itineraries that were not served during the previous winter season. In total, Air Canada, Air Transat, Flair Airlines, Porter Airlines, and WestJet have added flights on 52 routes that they had not operated in November 2024, which are displayed below.

(New flights to Tulum International Airport (TQO) and Rio Hato Scarlett Martínez International Airport (RIZ) are not displayed due to the mapping tool’s limitations.)

In general, the quintet’s weekly departing capacity, measured in available seat kilometers (ASKs), from Canada to Caribbean, Central American, Mexican, and South American airports, is up 31.8% year-on-year (YoY) in November. The same airlines’ weekly departing capacity to the US? Down 15.7% YoY, with the only airline adding flights to the US being Porter Airlines.

The airline has scheduled four additional weekly departures to the US compared to November 2024, Cirium’s Diio Mi showed, which is not much, to say the least. On September 29, American Airlines and Porter Airlines announced that they had launched a codeshare agreement.

Even then, the single month’s capacity changes do not reflect the full extent of Canadian airlines’ pivot toward other markets, including the Caribbean, during the colder months of the year.

For example, on October 1, Porter Airlines announced that starting February 7, 2026, it will be flying between Montréal-Pierre Elliott Trudeau International Airport (YUL) and Nassau Lynden Pindling International Airport (NAS), its first-ever Caribbean route.

Kevin Jackson, the President of Porter Airlines, said that its expanded winter season schedule represented “a major expansion of Porter’s network due to the strong response from customers for our new and existing sun markets.”

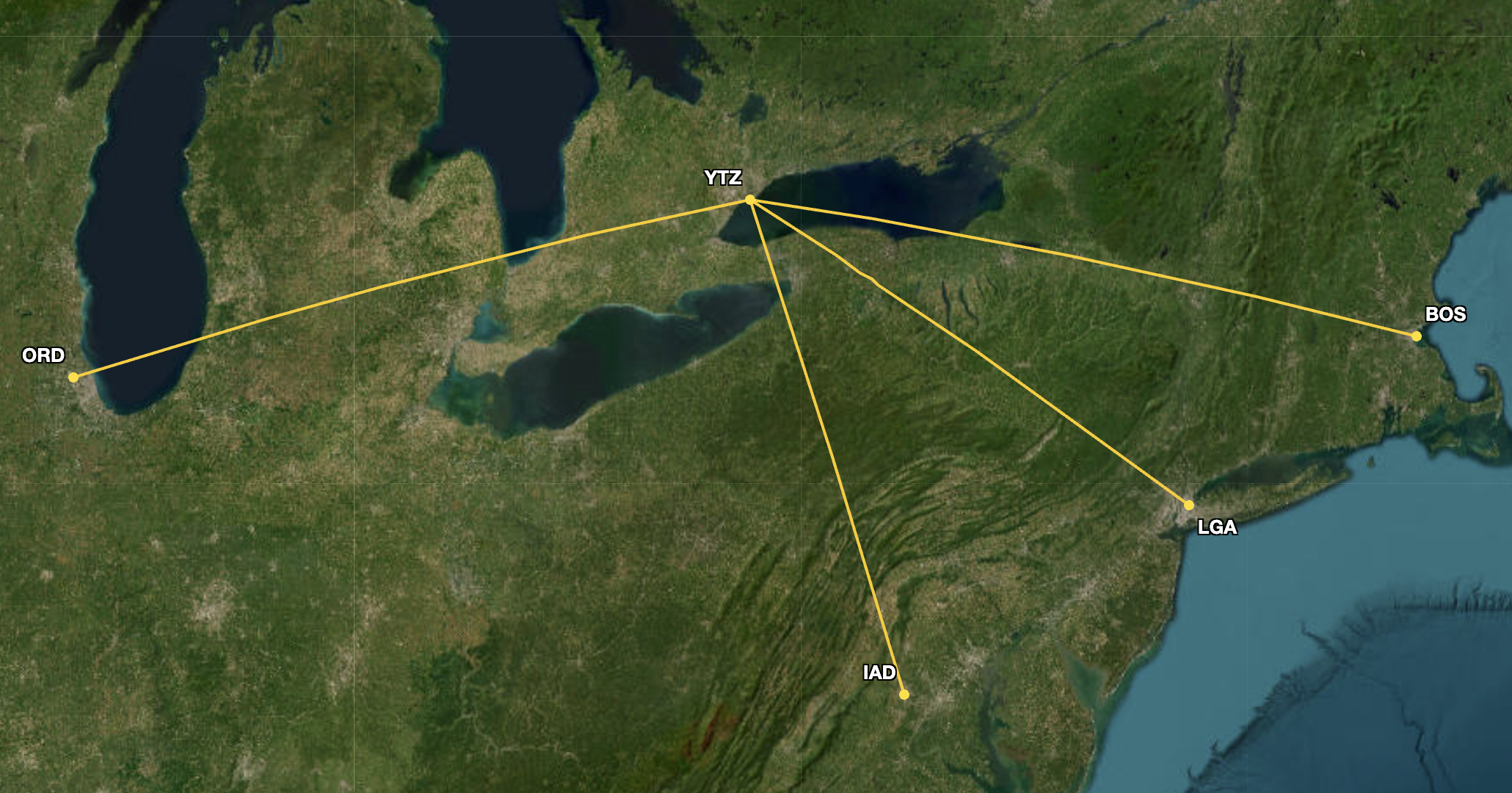

Air Canada underpins an even more contradictory tone to that pivot. On October 23, the airline unveiled a major expansion at Toronto Billy Bishop City Airport (YTZ), not only adding more frequencies on domestic routes, but also launching daily flights to four US airports: Boston Logan International Airport (BOS), Chicago O’Hare International Airport (ORD), New York LaGuardia Airport (LGA), and Washington Dulles International Airport (IAD).

The flights, scheduled to begin between March 2026 and July 2026, will benefit “our loyal customers and business travellers by creating frequent and easy connections between the heart of Canada’s financial capital and the major markets” of BOS, LGA, ORD, and IAD, said Mark Galardo, the Chief Commercial Officer and President of Cargo at Air Canada.

Still, while the new YTZ routes target business travelers, the quintet’s weekly departures to Florida, which had been a staple for Canadians looking for sunshine during the colder months of the year, are down 17.9% YoY, for example.

During Air Transat’s Q3 2025 earnings call on September 11, Annick Guérard, the President and Chief Executive Officer (CEO) of the Canadian carrier, said that during the quarter, which ended on July 31, “demand exceeded expectations as traveler preferences shifted away from the US in favor of Mexican and Caribbean destinations.”

Guérard added that as the airline enters the winter season, there is strong demand for sunshine destinations, “supported by a shift in consumer behavior away from US travel.” The CEO noted that the airline’s booking curve, load factors, and yield supported the carrier’s confidence “that the market is going to be able to digest this capacity increase” on routes south of the US.

However, she warned that consumer confidence is shaky and that the airline has witnessed more last-minute bookings. “There is a little bit less confidence, maybe in terms of economic trends,” Guérard explained, pointing out that economists expected consumer confidence to improve in 2026.

The International Trade Administration’s (ITA) data showed that as of June, year-to-date (YTD) Canadian arrivals to the US had dropped 17.7%.

At the same time, the situation remains fluid. After the Government of Ontario launched a TV ad, which included the narration of Ronald Reagan talking about the damaging impact of tariffs, Donald Trump, the President of the US, and I really struggled not to put something sarcastic here, called the ad a “fraud” in a post on Truth Social, claiming that Reagan “loved tariffs for the purposes of National Security and the Economy, but Canada said he did not.”

“Their Advertisement was to be taken down, IMMEDIATELY, but they let it run last night during the World Series, knowing that it was a FRAUD. Because of their serious misrepresentation of the facts and hostile act, I am increasing the Tariff on Canada by 10% over and above what they are paying now.”

Out of the five Canadian carriers, only Air Canada and Air Transat are publicly listed. The former should disclose its Q3 financial results on November 5.

Meanwhile, Cirium’s Diio Mi showed that in November, the five US airlines flying to Canada, American Airlines, Alaska Airlines, Delta Air Lines, JetBlue, and United Airlines, will add 15 weekly frequencies compared to the same month a year prior. Their capacity on transborder routes should grow 3.4% YoY.