During the company's Q3 2025 earnings call, Delta Air Lines executives have promised to be much more aggressive in building out bookings in the transatlantic market in 2026, yet capacity growth will be limited to low single digits during the upcoming peak period in the summer.

Glen Hauenstein, the President of Delta Air Lines, admitted that the airline’s Q3 transatlantic performance was “clearly disappointing,” pinning some of the blame on the carrier’s strategy and planning regarding the booking curves and how it held out for higher fares.

In response, the airline is “going to be much more aggressive in building a solid book earlier in the year,” with the executive noting that, amidst the trade and tariff chaos caused by the trade policies of the Trump administration, the ‘spring swoon’ happened during the booking window for the latter part of the summer.

The drop-off in consumer demand, mainly affecting the economy cabins, resulted in Delta Air Lines’ Q3 transatlantic passenger revenues contracting by 2% year-on-year (YoY), despite capacity, measured in available seat miles (ASMs), growing by 5%. Revenue passenger miles (RPMs) improved by 3% YoY, while passenger mile yield and passenger revenue per available seat mile (PRASM) were 5% and 7% lower, respectively, with load factors shrinking by 2%.

“The decrease in the Atlantic region is primarily driven by lower main cabin revenue, while premium products continued to perform well, and a shift in some leisure travel out of peak summer months.”

However, Hauenstein remained positive that, given the premiumization of the airline, the fall has also become “a relatively more attractive period than the summer in terms of high-yield leisure.” In addition, its product “is best in class in the Transatlantic,” with further improvements to come as it takes delivery of new aircraft with the new Delta One (business class) suites, enhanced Delta Premium Select (premium economy), and a larger Delta Comfort+ (improved economy class) cabin.

“We have chosen not to fly narrowbodies in the Transatlantic because of product and brand issues.”

According to Cirium’s Diio Mi, Delta Air Lines’ narrowbody transatlantic operations peaked during the three summer months, with 12 weekly Boeing 757-200 departures from Minneapolis-Saint Paul International Airport (MSP) and Detroit Metropolitan Wayne County Airport (DTW) to Reykjavik Keflavik International Airport (KEF), split between daily and five weekly departures, respectively.

The carrier’s President predicted that there would not be a fall in demand – ‘spring swoon’ – and that with its more aggressive approach to fill up its economy class cabins earlier in the booking curve, as well as capacity adjustments, the airline should have a better distribution of capacity during the International Air Transport Association (IATA) summer 2026 season.

As such, Hauenstein estimated that Delta Air Lines’ capacity in the transatlantic market next year could grow in the low single digits, with capacity growth in July and August 2026 probably being in the “very low-single digits growth.” The shoulder season, which is becoming “more peaky,” should also be higher, he said.

Cirium’s Diio Mi showed that now, the airline’s capacity from North America to Europe should grow 3.6%, with the number of flights scheduled between March 1 and September 30, 2026, growing by 4.5% YoY.

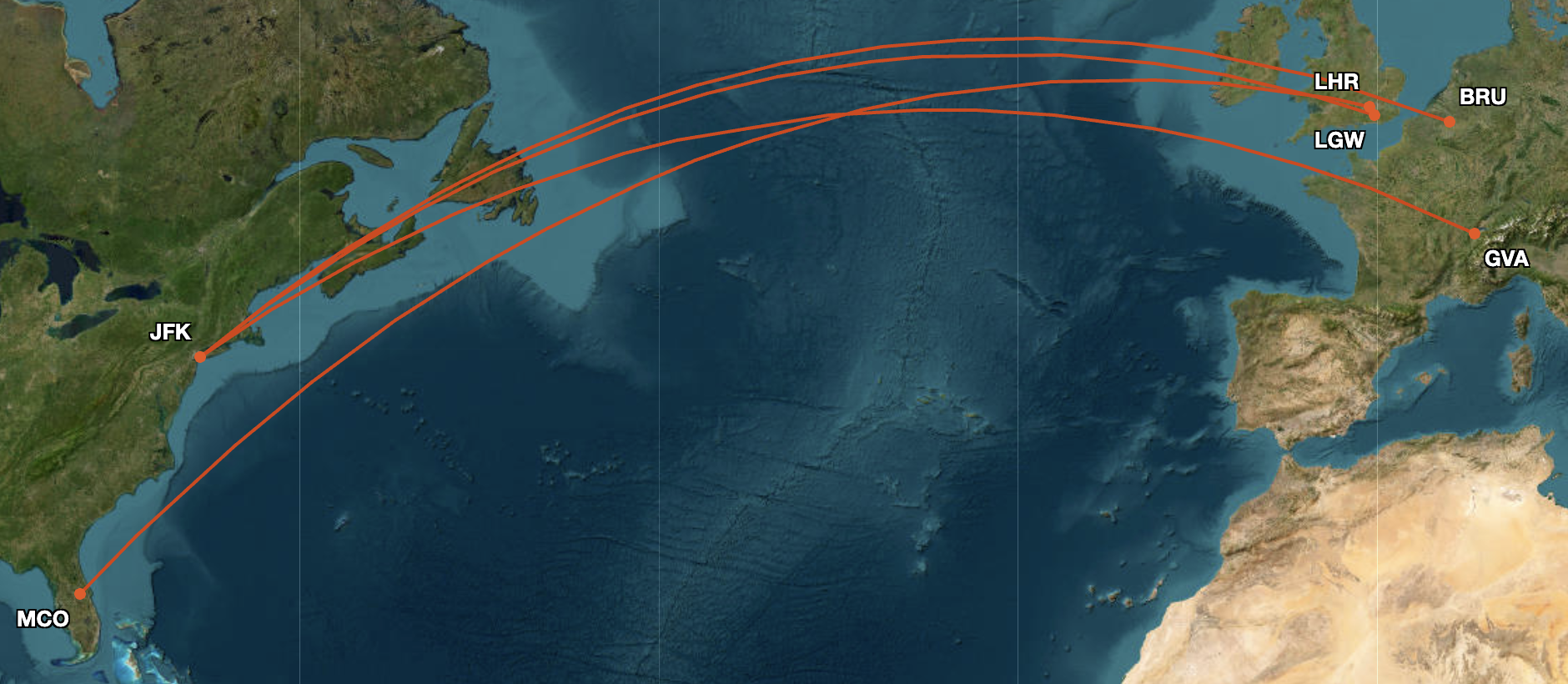

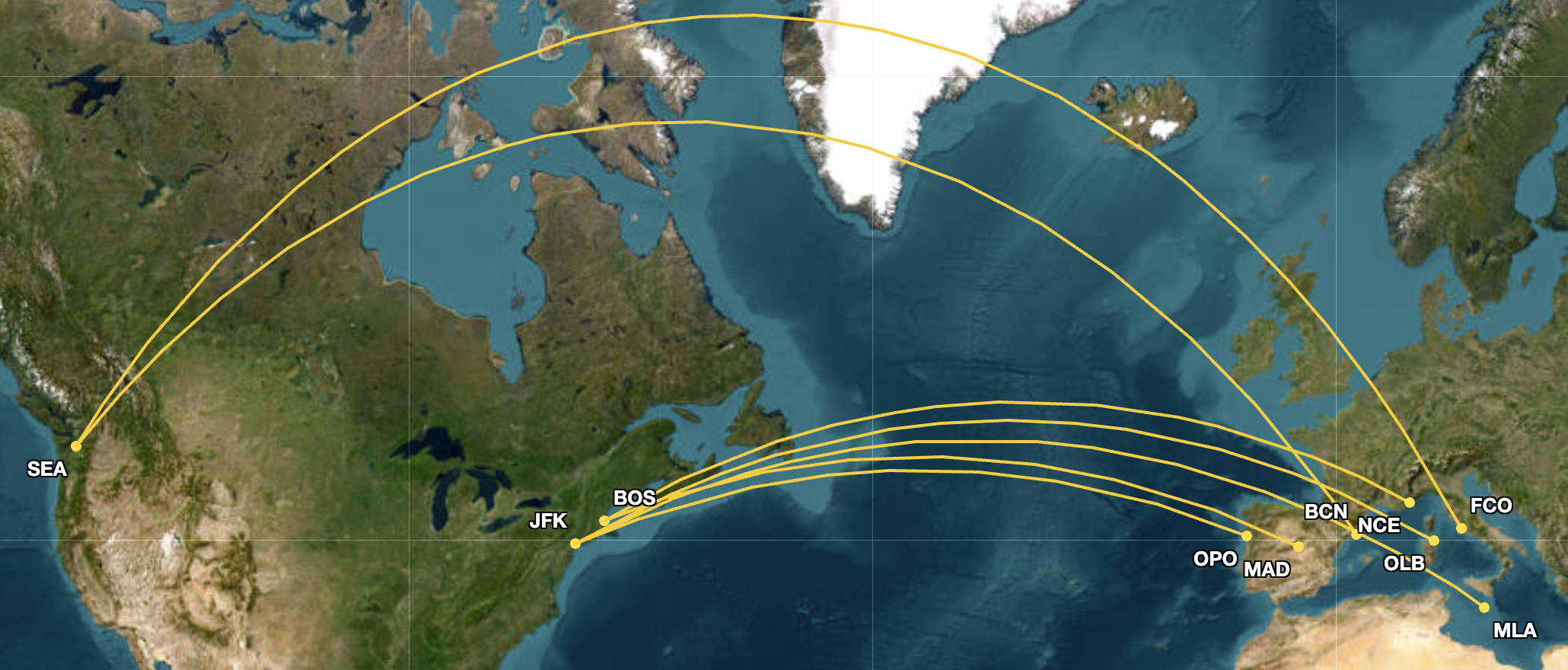

This includes cuts to four routes – displayed below in red – and the introduction of seven new connections (displayed below in yellow), including flights to Luqa Malta International Airport (MLA) and from Seattle-Tacoma International Airport (SEA) to Rome Fiumicino Airport (FCO).

The latter is a direct response to Alaska Airlines launching its own SEA to FCO flights.

Photo: Great Circle Map

Delta Air Lines’ transatlantic results should not be impacted by potentially lower European-side demand, since, according to Hauenstein, the airline has always been US point-of-sale driven on flights across the Atlantic Ocean.

“[…] our point-of-sale revenue […], we are approaching 80% US point of origin. […] we hope that there is going to be more.”

While Hauenstein hoped that the European point-of-sale revenue would improve, he admitted that consumers have safety concerns when it comes to traveling to the US, but the question is not whether there will be demand, but how much of it will be there during the upcoming summer season.

“But I would expect, hopefully, that next year is a little bit better than this year for European point-of-sale. If for nothing else is the appreciation of the euro has made European fares look relatively more attractive.”

Ed Bastian, the Chief Executive Officer (CEO) of Delta Air Lines, chipped in by saying that Europeans have not stopped traveling. While the numbers might be down right now in some markets, in the long term, the carrier will continue looking for markets to expand to.