Airbus has issued its H1 2025 financial results, with the European plane maker, which has continued to face challenges in its supply chain, improving its net profit result compared to the first six months of 2024.

The company finished H1 2025 with revenues of €29.6 billion ($33.8 billion), with net income rising from €825 million ($943.4 million) to €1.5 billion ($1.7 billion). Guillaume Faury, the Chief Executive Officer (CEO) of Airbus, praised the company’s performance during the six-month period, saying that it was strong.

“Our H1 financials reflect transformation progress in our Defence and Space division and the lower commercial aircraft deliveries compared to a year ago,” Faury said, adding that while Airbus is producing aircraft in line with its plans, the manufacturer’s deliveries will be backloaded due to persistent supply chain issues on the A320neo aircraft family.

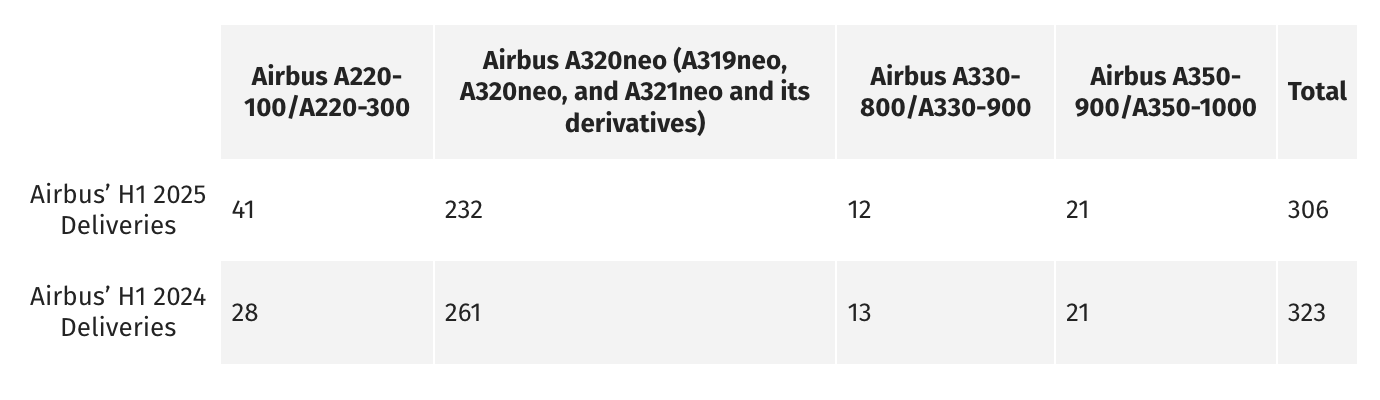

In H1 2025, the company delivered 306 commercial aircraft, compared to 323 in H1 2024. During the earnings call shortly after the release of its financial results, Faury reiterated Airbus’ back-heavy delivery profile in 2025, saying that during the first six months of the year, the plane maker had produced aircraft “in line with [its] plan,” but with engine makers struggling to supply engines to meet production demand, Airbus had 60 gliders as of June 30, 2025. “60 aircraft fully produced, but with engines missing,” Faury clarified. According to the CEO, the number of gliders will peak in the summer before normalizing during the last few months of the year.

“Engine partners, if you listen to me, I am really counting on you,” Faury said during the earnings call. (And yes, that is a direct quote.)

The so-called gliders are related to the engine supply shortages for the A320neo aircraft family. At the end of 2024, when Airbus was pushing to end the year being at least relatively close to its then-delivery target of “around” 770 aircraft, the company pushed its suppliers, including CFM International and Pratt & Whitney, to deliver more engines for new aircraft. In December 2024, Airbus handed over 123 aircraft to its customers, including 21 on December 30, 2024, and December 31, 2024, ending the year with 766 deliveries. The company later admitted that its 2025 delivery numbers will be lower during the first half of the year.

Airbus’ commercial aircraft deliveries in H1 2025 and H1 2024 are compared below:

In terms of orders, Airbus’ gross orders in H1 2025 numbered 494 aircraft, with Faury noting that the 92 cancellations, resulting in 402 net orders, “were largely anticipated and already embedded in [its] backlog valuation […] as of December 2024.” In H1 2024, gross and net orders numbered 327 and 310 aircraft.

Additional orders for the A330neo, with the company adding 71 A330-900 aircraft to its backlog in H1 2025, enabled Airbus to plan to increase the monthly production rate of the type from the currently stabilizing four per month to five per month in 2029. In terms of production rates for other commercial aircraft programs, Airbus continues to target 75/month for the A320neo family, while challenges related to Spirit AeroSystems and the acquisition of specific work packages “are putting pressure on the ramp up of the A350 and the A220.” Airbus is targeting rates of 14 per month by 2026 and 12 per month by 2028 for the A220 and A350 aircraft families, respectively.

Airbus said that it has been making progress on acquiring work packages related to its commercial aircraft programs from Spirit AeroSystems, which should be merging with Boeing “later in the year,” according to the latter. However, the transaction’s closing date has now shifted to Q4 2025 due to the lack of regulatory approvals, despite “all parties […] putting the necessary efforts into the closing process.”

At the same time, Faury remarked that the global trade environment has gone back to being tariff-free following the trade agreement between the United States and the European Union (EU). The CEO stated that “a stable and predictable trade environment is essential for [the] highly integrated global aerospace industry.” According to the European Commission’s (EC) statement explaining the trade deal, on August 1, 2025, US tariffs on EU-made aircraft and aircraft parts “will go back to pre-January levels.”

The company reiterated its guidance, which has been excluding the impact of tariffs, estimating that it would deliver around 820 commercial aircraft, have an adjusted earnings before interest and taxes (EBIT) of €7 billion ($8 billion), and a free cash flow – before customer financing – of around €4.5 billion ($5.1 billion). The guidance includes the impact of the integration of specific Spirit AeroSystems work packages based on preliminary estimates, including the transactions closing in Q4 2025.

Notably, free cash flow – before customer financing – was a negative €1.6 billion ($1.8 billion) during H1 2025, “reflecting the planned inventory build-up to support the ramp-up across businesses and the high level of produced commercial aircraft awaiting engines,” the company said.