With the three major European low-cost carriers having reported their latest quarterly results, The Engine Cowl looks at how easyJet, Ryanair, and Wizz Air performed during the quarter.

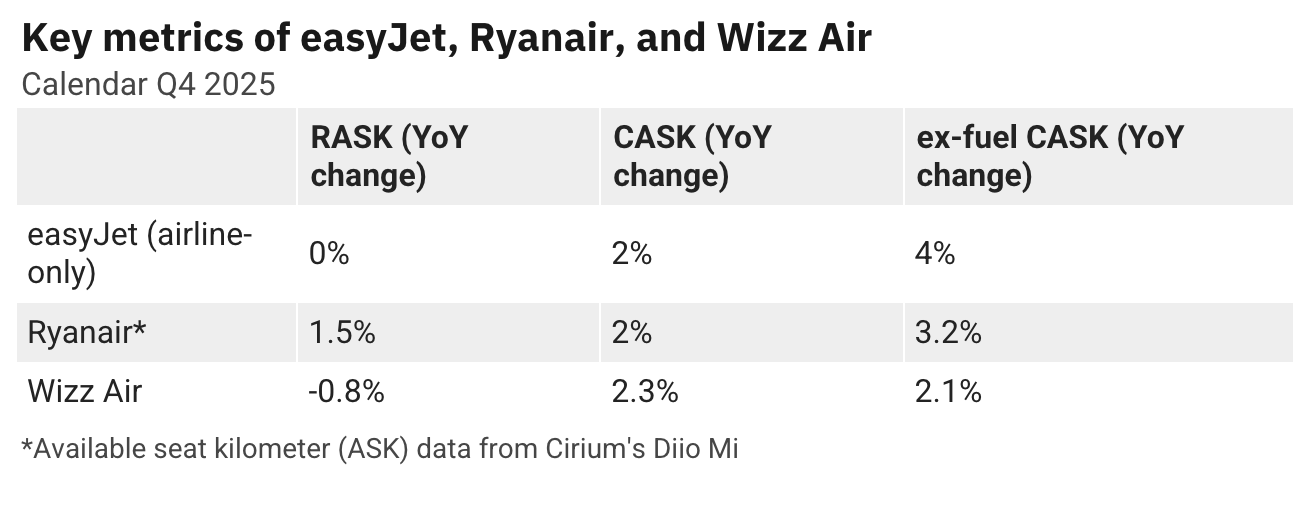

Of the three airlines, Ryanair was the only one to improve its unit revenues, or revenues per available seat-kilometer (RASK), while easyJet’s were flat. Wizz Air’s quarterly unit revenues decreased slightly despite a shorter stage length. The airline pointed out that its ticket RASK was up 0.2% YoY, while ancillary unit revenue was down 2%.

The trio shared a commonality: they all saw their unit costs, or cost per ASK (CASK), go up. However, the inflation of Wizz Air’s unit costs, excluding fuel, was the lowest out of all three. Ryanair’s would have been lower if not for an exceptional charge of €85 million ($100 million), or 33% of its total fine from the Italian Competition Authority (Autorità Garante della Concorrenza e del Mercato, AGCM), which the airline called “baseless.”

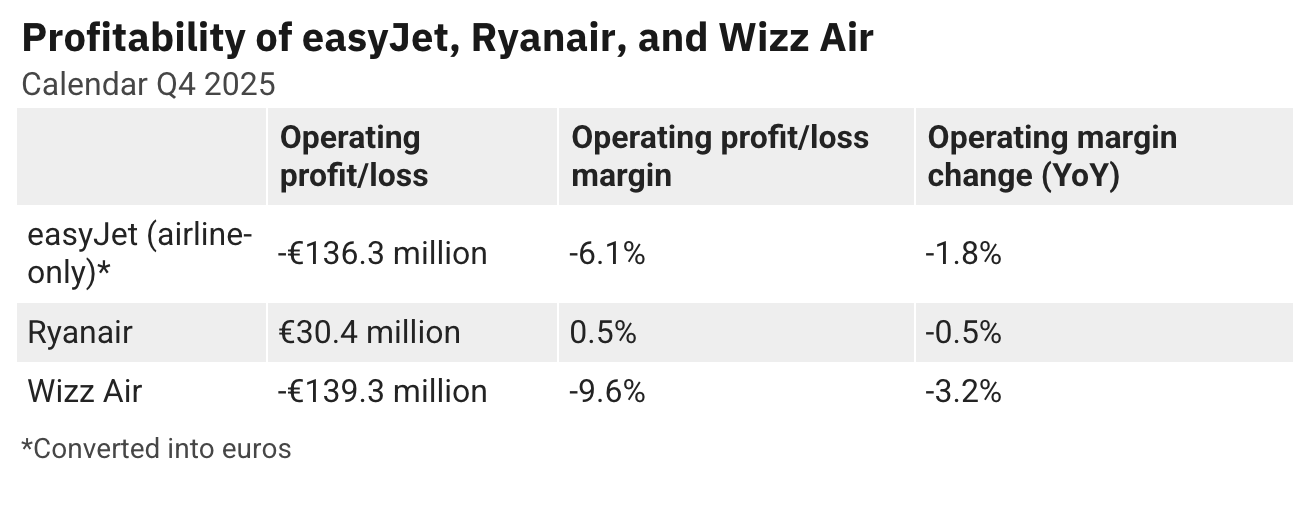

Still, Ryanair was the only one of the three airlines to deliver a profitable quarter. Wizz Air noted that the increase in its operating loss was “mainly driven by the previously guided higher depreciation charge as maintenance on older [Airbus A320ceo family aircraft] is capitalized and depreciated ahead of maintenance event before they exit the fleet.”

easyJet explained that its loss, also higher compared to Q1 FY26, reflected its first winter operating flights at Milan Linate Airport (LIN) and Rome Fiumicino Airport (FCO), where it was the remedy taker of slots after the European Commission (EC) outlined its conditions to approve Lufthansa Group’s acquisition of an initial 41% shareholding in ITA Airways.

The British airline noted that the impact from the still-immature network at LIN and FCO and continued competitive environment in some markets was “partially offset by profit growth in easyJet holidays and the continued reduction in disruption costs.”