As Frontier Airlines has continued to add flights to its schedule, which is now updated through September 8, 2026, the low-cost carrier has continued to grow at Hartsfield-Jackson Atlanta International Airport (ATL). The airport will have more of the airline's flights than Denver International Airport (DEN), which historically has been the airline’s main base.

The Engine Cowl explores how and why Frontier Airlines has chosen to grow at ATL, which now overshadows DEN, and how the airline’s route networks differ at both airports.

Adding more flights at ATL

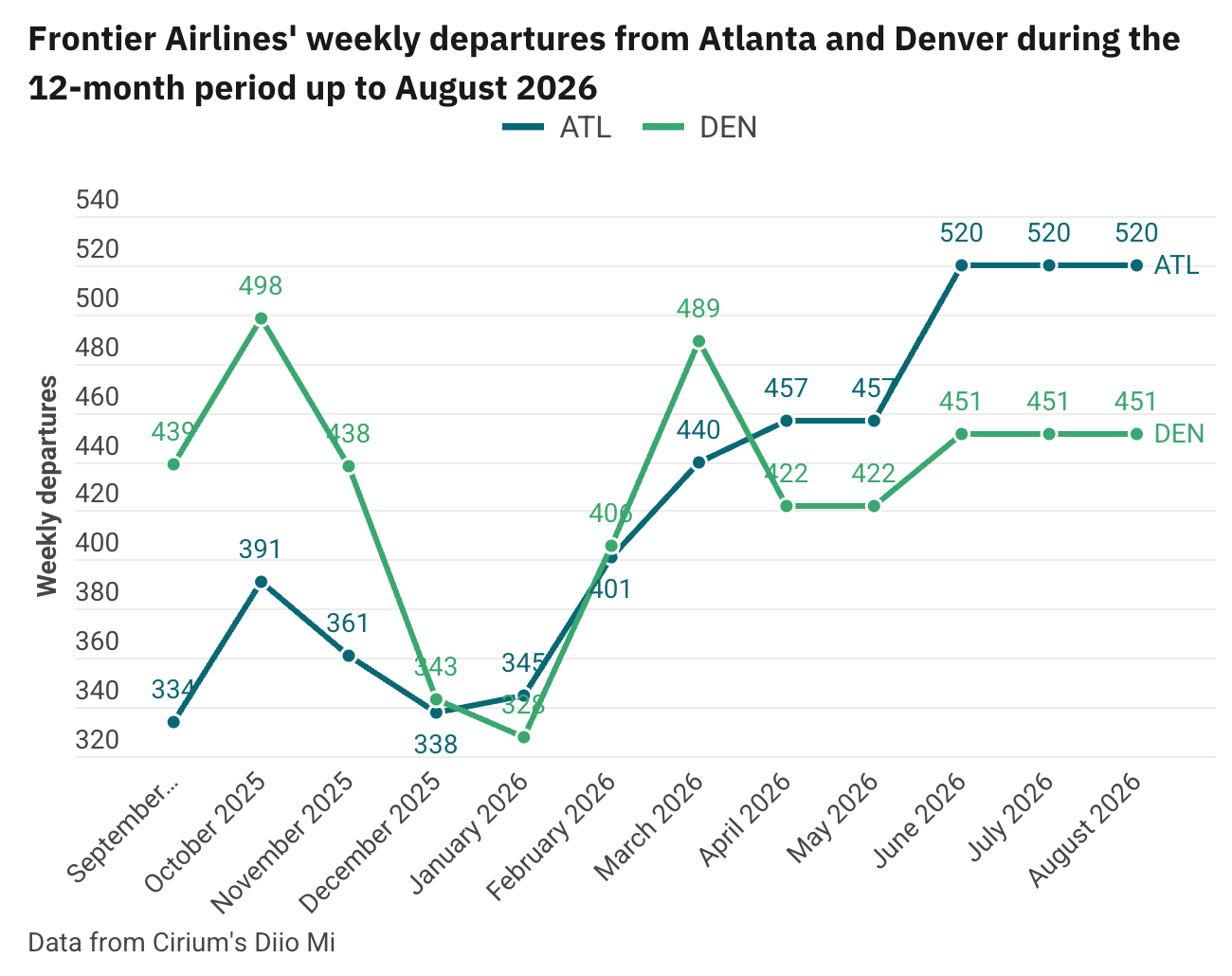

Cirium’s Diio Mi shows that during the 12 months up to August 2026, Frontier Airlines initially had a significant gap in weekly departures between ATL and DEN, with the Colorado airport leading with nearly 500 weekly departures in October 2025, compared to ATL’s 391.

However, as the low-cost carrier wound down operations during the lower-demand months, the gap narrowed. By January 2026, ATL was slightly ahead of DEN, and while DEN will have more Frontier Airlines flights than ATL in February and March, between April and August, the situation is flipped.

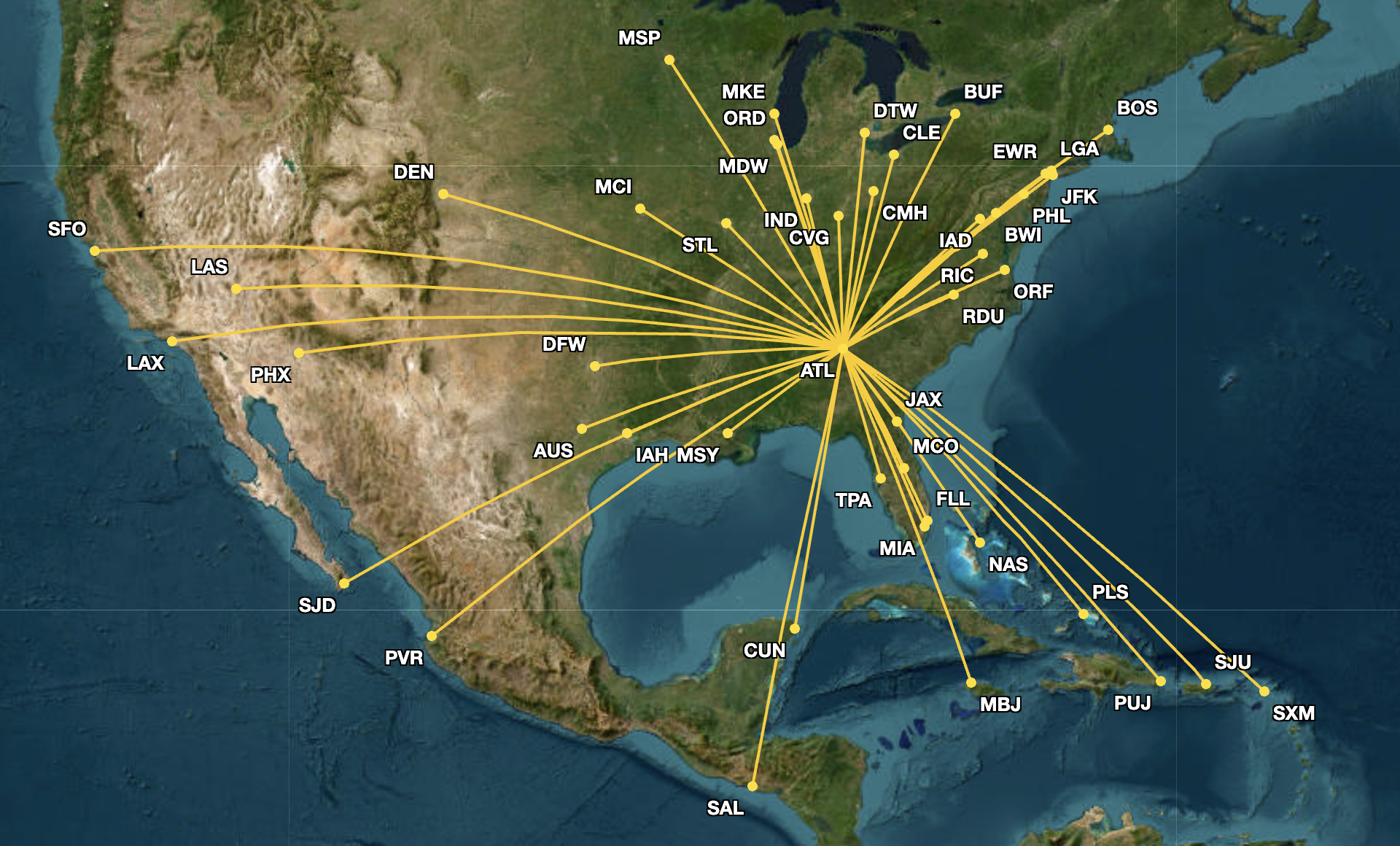

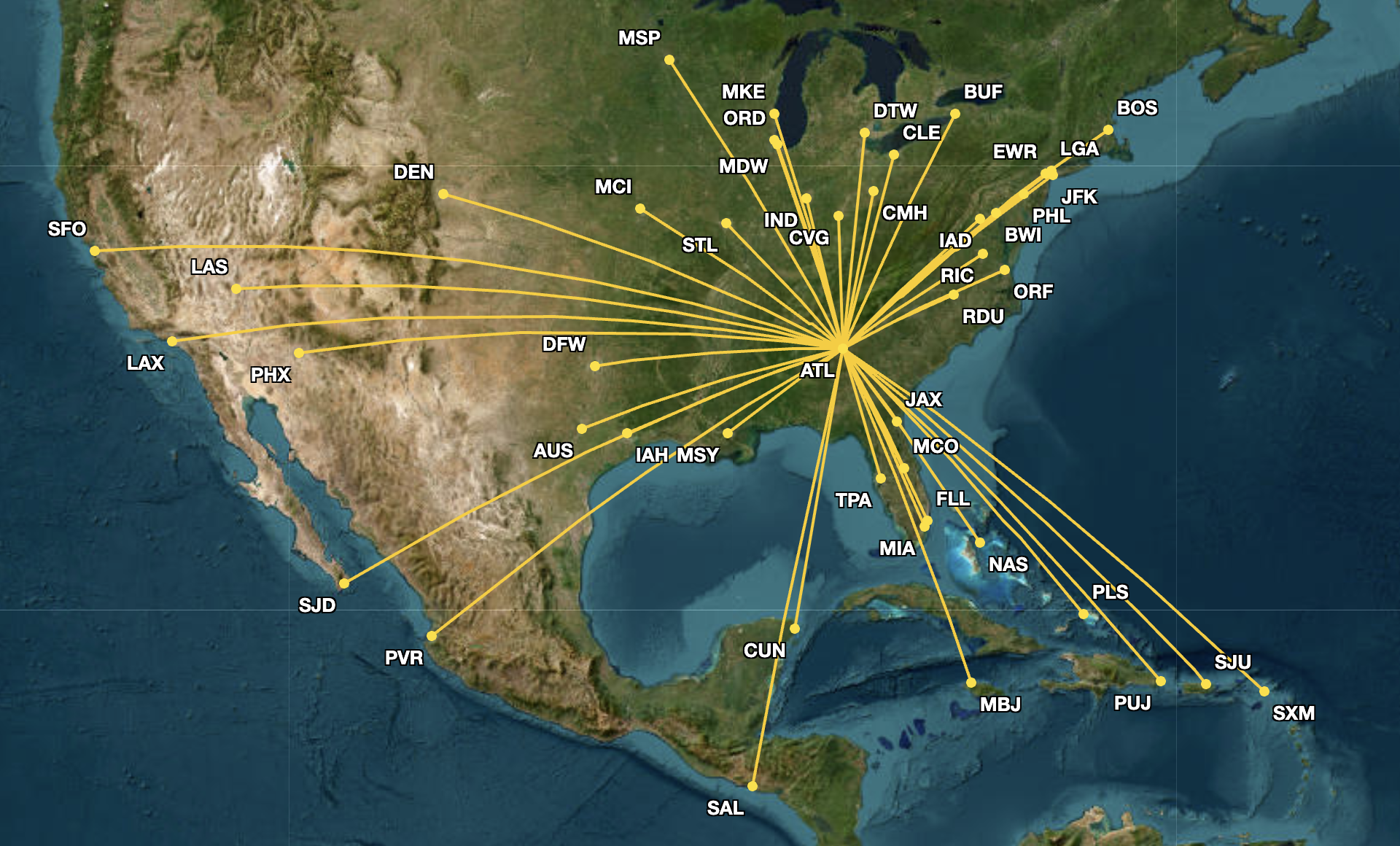

Looking at Frontier Airlines’ route maps from both airports in August, there are some key differences. From ATL, the carrier primarily serves the Midwest and the Eastern part of the country, as well as the Caribbean, with some service to Mexico and El Salvador.

At DEN, in addition to flying from/to the Midwest, Frontier Airlines has a much more extensive network across the West Coast, including flights to Seattle-Tacoma International Airport (SEA) or San Diego International Airport (SAN).

From ATL, West US flying is limited, with the low-cost carrier having scheduled flights to only four airports: Las Vegas Harry Reid International Airport (LAS), Los Angeles International Airport (LAX), Phoenix Sky Harbor International Airport (PHX), and San Francisco International Airport (SFO).

Competitive environment

During the Q4 2025 earnings call on February 11, 2026, when asked about the airline’s capacity growth plan of 10%, James Dempsey, the President and Chief Executive Officer (CEO) of Frontier Airlines, explained that the carrier will be “infilling our network from a growth perspective,” so half of that 10% growth will come from “filling out the existing network,” bringing back capacity on Tuesdays, Wednesdays, and Saturdays.

The other half will come from new markets, including “opportunities that are presenting themselves with changes in capacity across the environment.”

Those opportunities include favorable capacity environments at ATL, LAS, and other markets, Dempsey said.

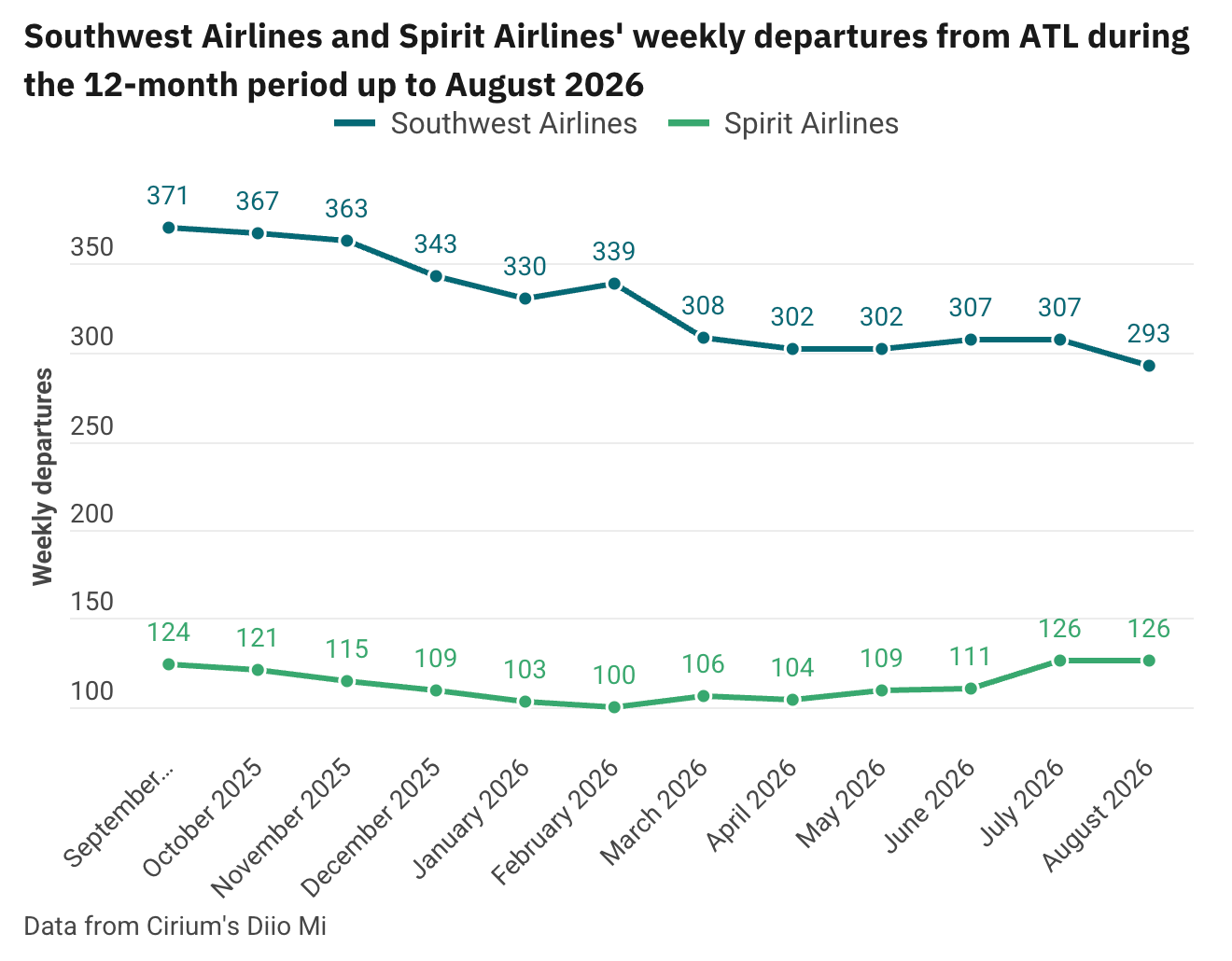

Dempsey later detailed that, “Southwest and Spirit reduced capacity in Atlanta.”

“[…] we have, for a long time, had an operation in Atlanta, and we have seen an opportunity to enhance that in terms of the volume of traffic flows that we are flying from Atlanta.”

Cirium’s Diio Mi shows that during the same 12-month period, Southwest Airlines has gradually reduced its frequencies from ATL. Overall, Southwest Airlines and Spirit Airlines’ total departures during that period are currently scheduled to be 31.6% and 35.1% lower than in the same 12-month period between September 2024 and August 2025.

Dempsey noted that around 2 years ago, Frontier Airlines and Spirit Airlines had around 50% of their networks overlapping. “It is now meaningfully lower than that and meaningfully lower than that in the West of the United States,” he added, continuing that with Spirit Airlines reducing capacity at certain markets, this will allow Frontier Airlines to “move more flights to off-peak days of the week and do it successfully.”

“We are also seeing some discipline across other airlines in terms of their capacity deployment. […] we are really encouraged by the performance in terms of our revenue generation with the changes that we made that we discussed earlier around the disciplined pricing strategy together with actually the new distribution capability that we have across all our OTAs now.”

When asked whether Frontier Airlines’ backfilling Spirit Airlines’ markets means that the airline is not going to be looking to acquire its restructuring rival, Dempsey said that he will not speculate about Spirit Airlines’ future, and pivoted by saying that he and the board are “solely focused on putting Frontier on a path back to sustainable profitability.”