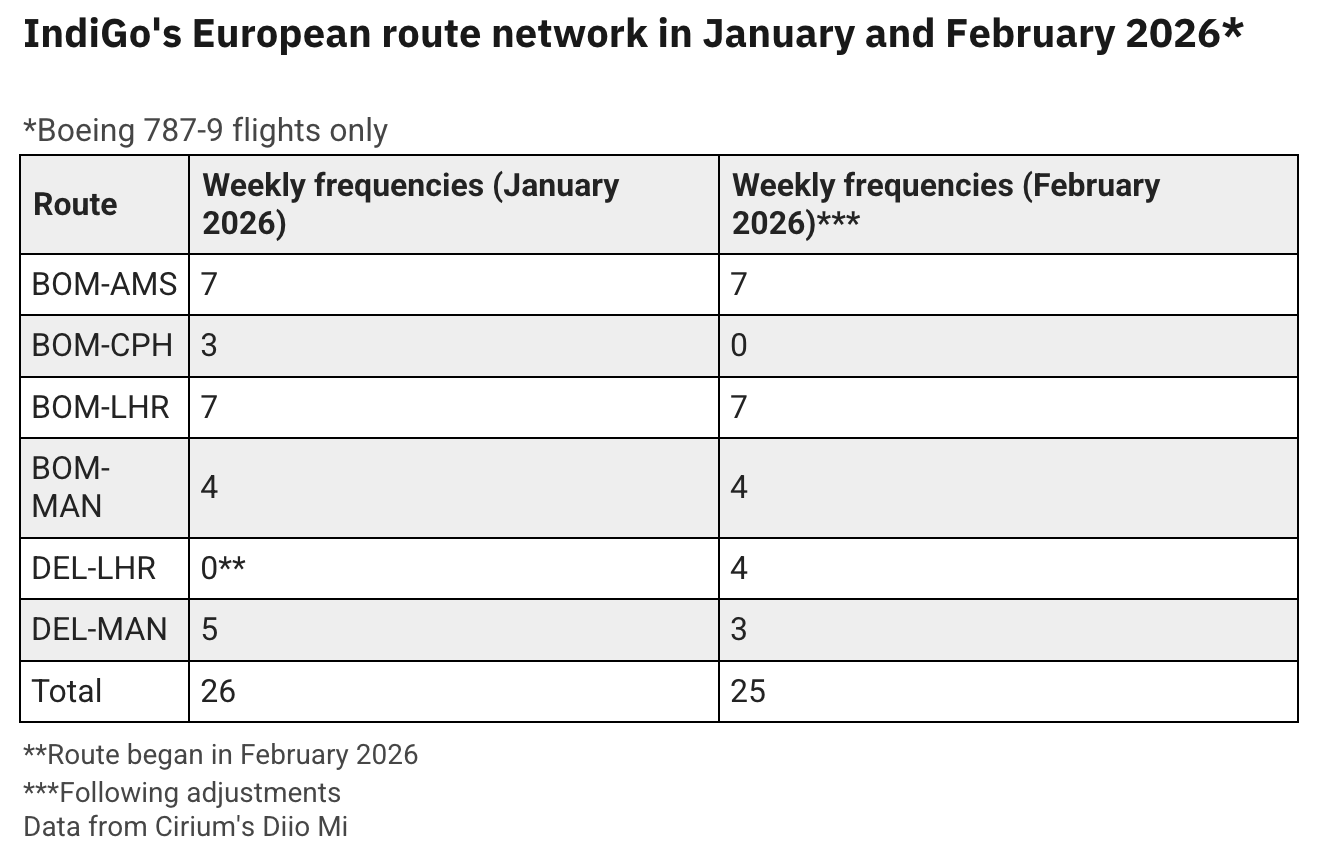

IndiGo has announced that it will be reducing flights on Europe-bound services that are operated with Norse’s Boeing 787-9 aircraft, including the end of its flights to Copenhagen Airport (CPH) “till further notice.”

IndiGo’s European flights facing external constraints

In a statement, IndiGo confirmed that it will adjust its route network and frequencies on its flights between India and Europe, affecting the itineraries that it operates with Norse’s 787-9s.

The Indian low-cost carrier, which has damp leased six 787-9 aircraft, said that effective February 17, its flights from Mumbai Chhatrapati Shivaji Maharaj International Airport (BOM) to Copenhagen Airport (CPH) will be suspended “till further notice.”

IndiGo will also adjust the number of weekly flights from Delhi Indira Gandhi International Airport (DEL) to Manchester Airport (MAN), first going from five to four weekly, then to thrice-weekly from February 19.

Flights from DEL to London Heathrow Airport (LHR) will also be affected, with the airline removing one weekly frequency from the route for the current winter 2025/2026 season schedule. The change will be in effect from February 9.

Overall, instead of the planned 30 weekly frequencies, IndiGo will have 25, which includes the addition of the DEL-LHR route. The airline began operating the latter on February 2, with an initial plan of five weekly departures.

“Recently, IndiGo’s widebody operation has faced external operational constraints; continuously changing airspace constraints due to geopolitical circumstances, congestion at airports both in India and abroad.”

Growing block times

IndiGo added that these constraints have resulted in longer flight and block times, straining the airline’s leased 787-9 fleet. “With the objective of avoiding inconvenience to customers due to misconnections and cascading delays,” it decided to immediately adjust its schedules, the airline added.

“By making these adjustments to its schedule, the airline strives to improve the reliability of its long-haul services and reduce disruption to connecting itineraries booked by its customers.”

The European Union Aviation Safety Agency (EASA), for example, issued a Conflict Zone Information Bulletin (CZIB) for Iran’s airspace on January 16. The bulletin, applicable to all airlines, including approved third-country operators (TCOs), warns about the growing military presence around Iran, increasing the likelihood of misidentification of military and commercial aircraft within Iran’s airspace.

“Considering the overall high level of tensions, Iran is likely to maintain elevated alert levels for its air force and air defence units nationwide.”

As such, EASA recommended that airlines avoid Iran’s airspace at all altitudes and flight levels, with the CZIB being valid at least until February 16. Iran had already shot down a civil aircraft in January 2020, downing a Ukraine International Airlines Boeing 737-800, registered as UP-PSR, which had departed Tehran Imam Khomeini International Airport (IKA).

In addition to airspace limitations over Iran, Indian airlines are prohibited from flying into Pakistan after the country’s Airports Authority (PAA) issued a Notice to Air Missions (NOTAM) banning aircraft operated or leased by Indian airlines from entering Pakistan’s airspace. The NOTAM’s validity has been extended to February 26.

Flightradar24 showed that in October, for example, IndiGo had operated flights from BOM to CPH in around eight hours and 30 minutes. The flight times have ballooned to over nine, sometimes 10 hours, in January.

Norse’s lease agreement

IndiGo still pointed out that, in addition to serving as a precursor to its Airbus A350-900 long-haul services, the lease agreement with Norse was part of its “internationalisation journey.”

The two airlines signed the agreement in March 2025, eventually expanding it to six aircraft, or half of Norse’s fleet.

Bjørn Tore Larsen, the Founder and the ex-Chief Executive Officer (CEO) of Norse, which had struggled to achieve sustainable profitability, said that the lease will support the “maximum utilization of the aircraft fleet, combining demand from both ACMI [aircraft, crew, maintenance, and insurance – ed. note] and own scheduled network.”

The split between operating six 787-9s on its own network and six on ACMI flights “represents a good balance between securing year-round fixed revenue from ACMI and maximizing the possibilities in our scheduled network.”

While Norse is yet to publish its Q4 2025 and full-year results, the airline ended Q3 2025 with a loss of $7.8 million. Larsen stated that even if the carrier still has challenges to address, the “balanced portfolio” of aircraft will provide predictable revenues, cash flow, and strengthen its financial position from ACMI flights as it continues to optimize its network, “flying routes with maximum passenger and fare potential.”

Norse’s Q3 2025 passenger revenues were $210.5 million, while its ACMI and charter income were $10 million. Then, it had only delivered two out of six 787-9s to IndiGo, with the remaining four joining the Indian airline’s fleet between October 2025 and January.

The long-haul low-cost carrier had $25.5 million of cash and cash equivalents at the end of Q3 2025.