London Gatwick Airport (LGW) has proudly announced that it will have its busiest summer ever, with the airport, London’s second-busiest, surpassing its 2019 levels with “a record number of airlines, fresh destinations, and expanded long-haul options.”

With London Heathrow Airport (LHR) remaining slot-constrained, The Engine Cowl explores how LGW's long-haul network has evolved compared to 2019.

Record-breaking summer

On February 19, 2026, LGW announced that during the upcoming summer 2026 season, it will have 62 airlines, eight of which are new to the airport, which will offer 230 destinations, “the airport’s broadest network since 2019.”

Among the eight new airlines, three are not based in Europe, namely AirAsia X, Air Arabia, and Beijing Capital Airlines, with LGW emphasizing that incumbent carriers are also growing their capacity at the airport.

Jonny Macneal, the Head of Aviation Development at LGW, reiterated that this will be the airport’s “most exciting and varied summer season in years,” adding that the airport’s “passengers will enjoy even more choice for holidays, business trips and long-haul adventures.”

However, among the new airlines adding new dots to LGW’s route map, only two long-haul destinations will be added compared to last year’s summer season: Kuala Lumpur International Airport (KUL) and Qingdao Jiaodong International Airport (TAO).

LGW’s network shifting east

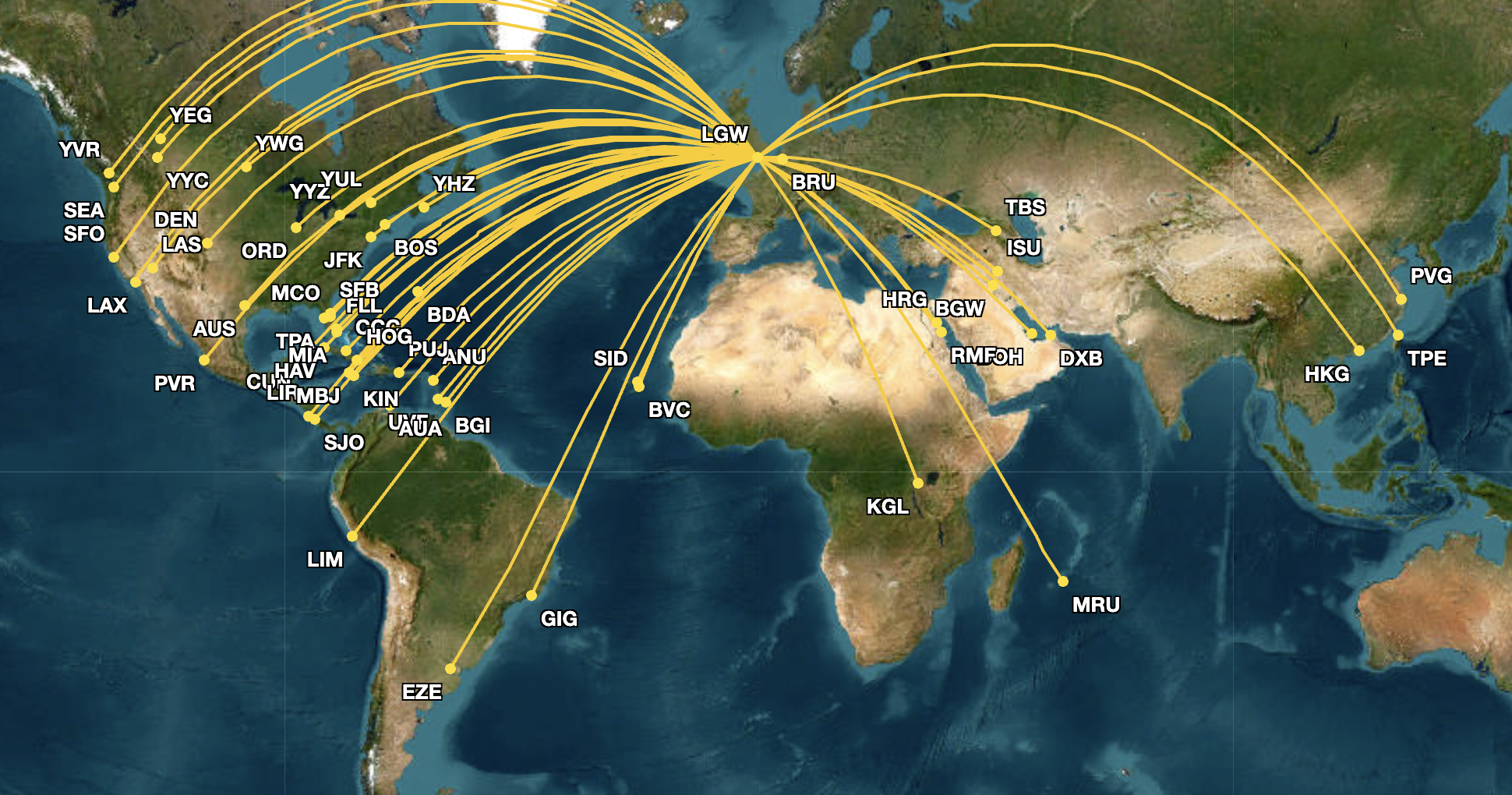

When comparing LGW’s long-haul – flights longer than 3,500 kilometers (1,889 nautical miles) – route map in July with the one in July 2019, the eye test reveals that the airport’s network has largely shifted eastward, especially to Asia.

Photo: Great Circle Map

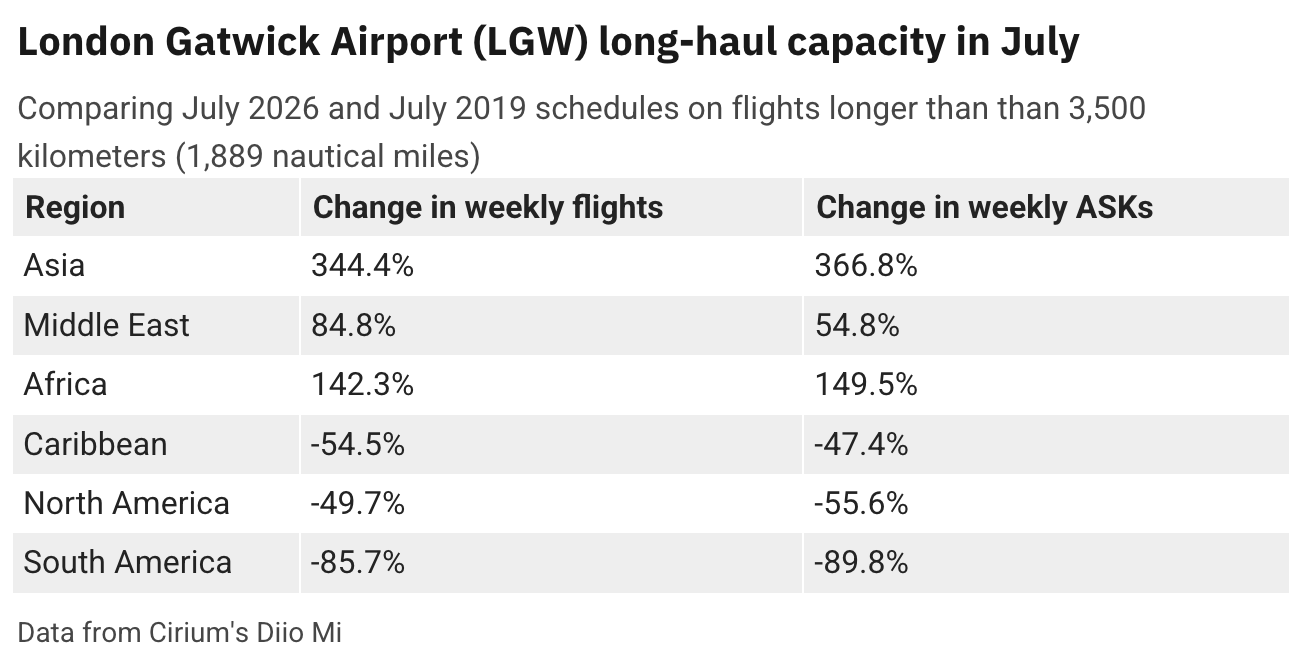

Cirium’s Diio Mi shows that overall, LGW’s long-haul capacity, measured in available seat kilometers (ASKs), will be down 11.6% in July compared to July 2019, including 4% fewer weekly frequencies.

One reason for the shift is Norwegian’s exit from the long-haul low-cost market. In July 2019, the low-cost carrier was the second-largest long-haul airline at LGW by ASKs, offering flights to 13 destinations, including 11 in the United States.

While out of the ashes of Norwegian’s long-haul ambitions rose Norse Atlantic Airways, the airline will only fly to three destinations from LGW in July 2026: Los Angeles International Airport (LAX), New York John F. Kennedy International Airport (JFK), and Orlando International Airport (MCO).

Virgin Atlantic also suspended long-haul flights from LGW in 2020.

But zooming out, Cirium’s Diio Mi data indicates that during the month, LGW’s North American weekly flights and ASKs will be half of the levels it had in July 2019, while Caribbean-bound capacity will be 47.4% lower.

Instead, LGW’s major growth regions will be Africa, Asia, and the Middle East.

Different markets

Unlike its northern neighbor, LHR, LGW offers limited connection options for passengers flying to Europe. While London is an attractive leisure and business destination in itself, LGW’s short-haul network is mostly comprised of low-cost carriers flying to leisure destinations during the summer, including various holiday destinations scattered across the Mediterranean.

According to Cirium’s Diio Mi, low-cost carriers such as easyJet, Norwegian, Ryanair, Vueling, Wizz Air, and others will operate 1,897 weekly flights on intra-European routes, or 72.9% of the airport’s total weekly departures to other European destinations.

John Strickland, who runs the independent airline consultancy JLS Consulting, told The Engine Cowl that while airlines see LGW “as a gateway to London in the absence of slots at [LHR], what we also see is that in many cases, when slots become available” at LHR, they move over.

“Having said that, LGW has its own distinct market, and many airlines fly out of that airport for that reason.”

Strickland emphasized that LGW’s market characteristics “are very different” from LHR’s, with the demographic of London tending to feed LHR in terms of the wealth profile of its customers.

“Therefore, [LHR] commands a strong yield premium, particularly for long-haul flights. That is why airlines, particularly long-haul network carriers, try to get into [LHR] if they can.”

LGW’s lower yields are not much of a problem when speaking about short-haul flights, Strickland emphasized, since low-cost carriers typically set “the pricing tone on many European short-haul markets.”

“Nevertheless, there are some viable long-haul markets out of [LGW], but these tend to be much more leisure-focused routes, such as to Florida, the Caribbean, and other leisure destinations.”

Strickland concluded that while some airlines have attempted to replicate LHR’s long-haul services at LGW, “we have seen them performing not so strongly or not being so sustainable for the long term.”