The Icelandic low-cost carrier, which has shifted to point-to-point travel from Iceland, as well as wet and/or damp lease services, has highlighted that its recent convertible bond issuance reflected investors’ confidence in its future.

According to the airline, which published its August 2025 operational data on September 8, 2025, during the month, it had completed the issuance of a two-year convertible bond. The financial instrument, used by companies to raise cash by giving investors an instrument to earn interest payments and convert their investment into equity in the company, grew to around $23 million.

The bond’s initial subscription commitments totaled $20 million, “but increased demand resulted in a higher final amount.” Investors included PLAY’s largest shareholders and “new Icelandic investors,” according to the company’s July 8, 2025, statement, which announced the then-planned convertible bond issuance.

“This outcome confirms the confidence investors have in Play and the company’s future. The financing significantly strengthens the company’s operational foundation and enables Play to focus on profitable projects and continued growth.”

PLAY ended Q2 2025 with a net loss of $15.3 million, compared to a net loss of $10 million in Q2 2024, ending the three-month period with $11.9 million in cash. The significant drop in cash ($39.5 million lower than in Q2 2024) was due to “reduced advance inflows under the new business model,” with fewer aircraft actively flying commercial operations on behalf of PLAY, and lower up-front payments from aircraft, crew, maintenance, and insurance (ACMI) operations.

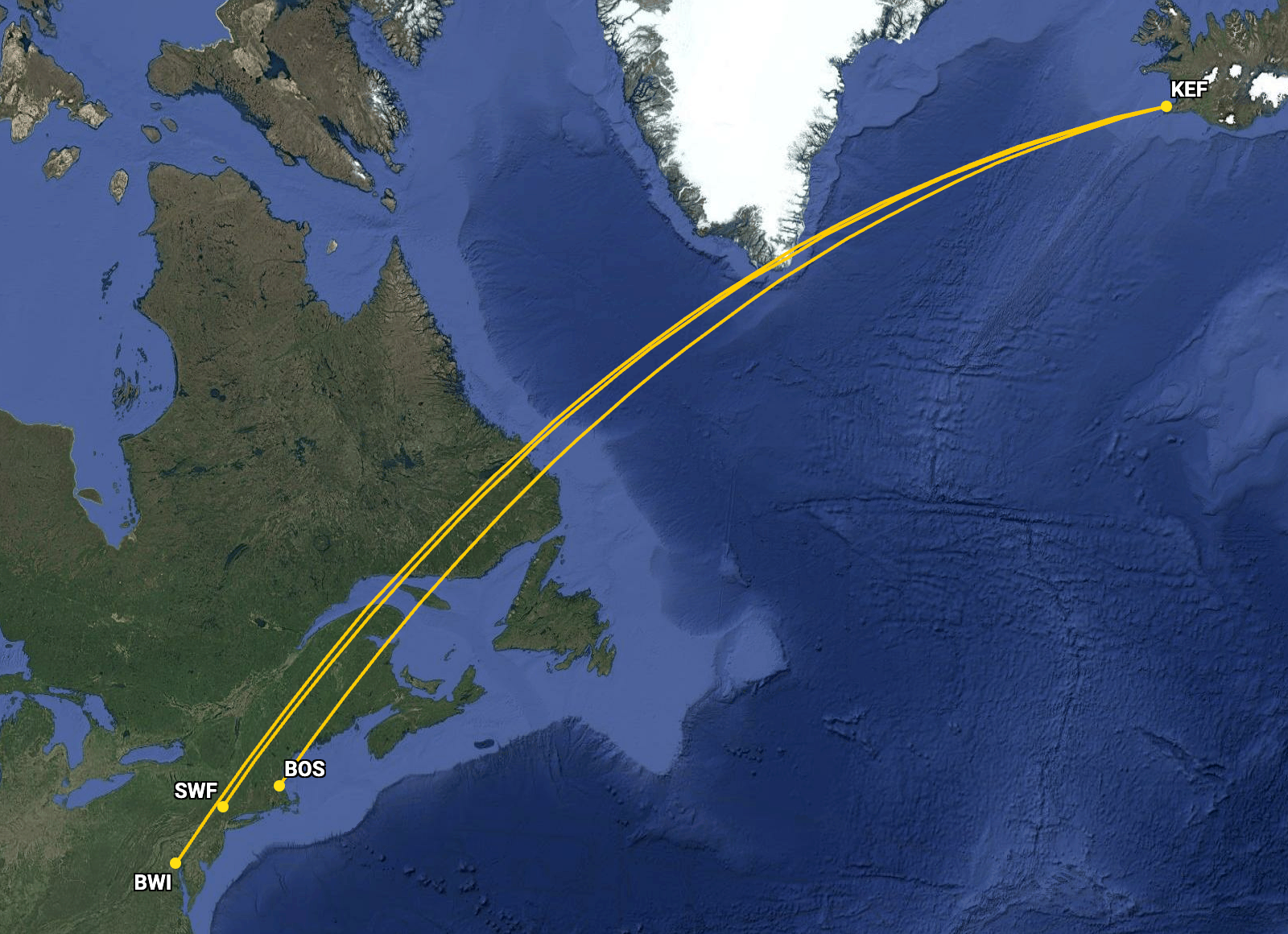

In August 2025, PLAY carried 124,286 passengers, with an average load factor of 89.6%. 33.7% of its passengers flew from Iceland, 47% to Iceland, and 19.3% via Iceland. During the month, the low-cost carrier still had three routes from Reykjavik Keflavik International Airport (KEF) to the United States, displayed below:

Cirium’s Diio Mi showed that PLAY does not have any scheduled services from KEF to the US beyond October 2025, reaffirming the airline’s June 2025 announcement that it would no longer fly west of Iceland, noting that US-bound and connecting flights were some of its “less successful parts of the business.”

While the announcement’s main story was that its shareholders, including Einar Örn Ólafsson, Chief Executive Officer (CEO) of PLAY, and Elías Skúli Skúlason, Vice Chairman of the Board, had attempted a takeover and a delisting, dropping the plan in July 2025, PLAY’s removal of flights to the US has remained true to this day.

Ólafsson noted that August was another strong month for the airline as it continues to transform its operations by deploying more aircraft to fly ACMI operations. “The results demonstrate that our focus on point-to-point leisure destinations is paying off, highlighted by the fact that this past August we achieved our highest ever unit revenue for the month of August,” the CEO added.

PLAY initially presented its plans to shift from a via-Iceland business model to focus on point-to-point leisure destinations from KEF, as well as ACMI services, in October 2024. Then, the airline detailed that, with airlines flooding the transatlantic market with additional capacity, its “yields on its hub-and-spoke part of the business across the Atlantic has been disappointing, particularly in 2024.”

As such, it responded by cutting back capacity on North American routes, which will result in the eventual exit from flying from Iceland to the United States in October 2025.

Its Icelandic rival, Icelandair, however, reported improving numbers in August 2025. On September 8, 2025, Icelandair said that during the month, it carried 608,000 travelers, an increase of 1% year-on-year (YoY), with 40% of its passengers flying to Iceland, 14% from Iceland, 42% via Iceland, and 4% on domestic routes.

As of August 2025, Icelandair had welcomed 3.4 million passengers, an increase of 8% compared to the same eight-month period in 2024.