Ryanair has announced that it will expand its base at Budapest Ferenc Liszt International Airport (BUD), adding an 11th aircraft to its base at the airport, resulting in five additional routes and a 5% year-on-year (YoY) increase in scheduled seats.

Growing BUD base

On February 17, 2026, Ryanair said that it will base its 11th Boeing 737 aircraft at BUD, with six of those aircraft being the next-generation 737 MAX 8-200.

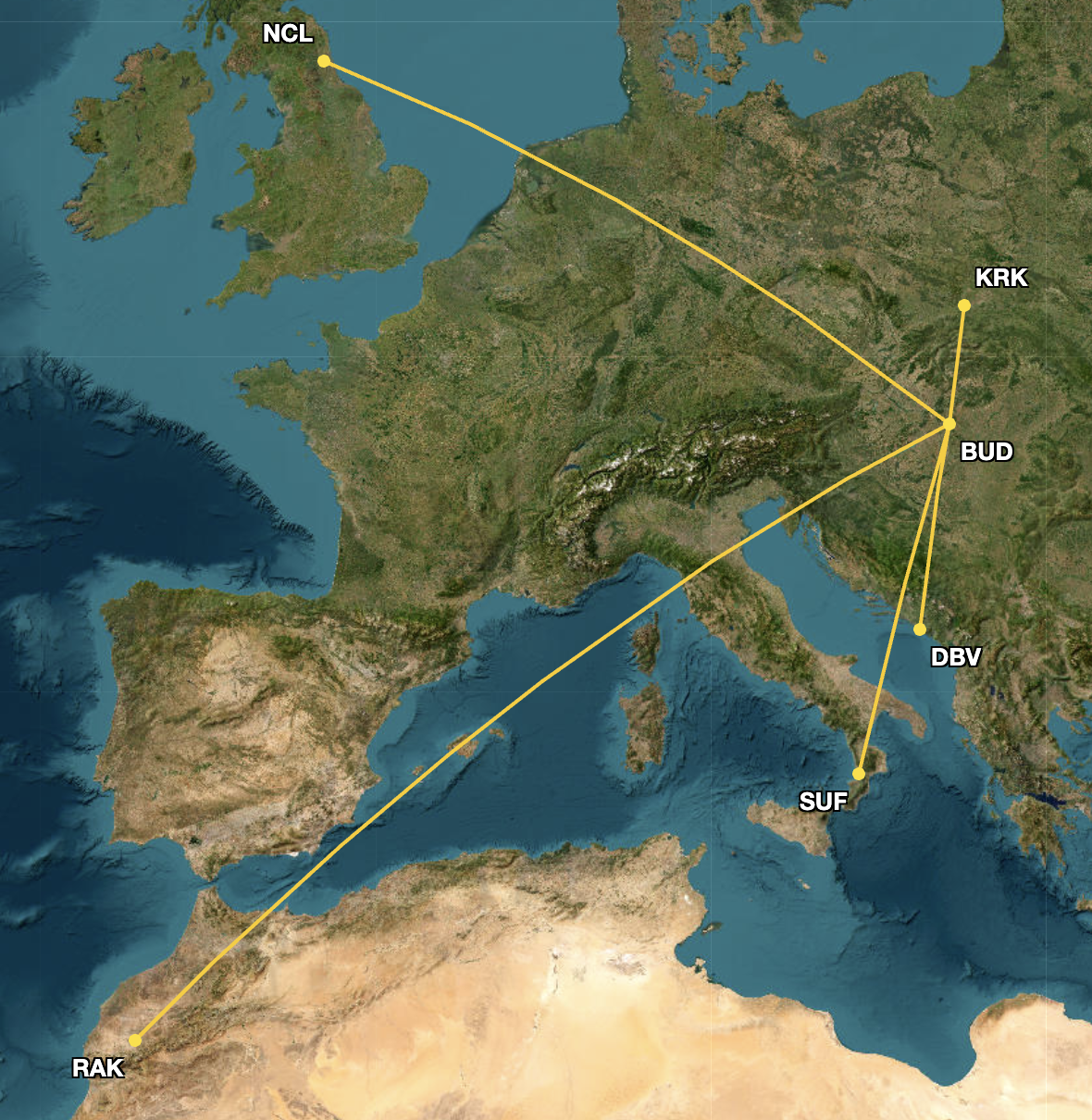

The addition of another aircraft to the base will facilitate the Irish low-cost carrier’s plans to launch five new routes from BUD for the upcoming summer 2026 season, which are displayed below:

Cirium’s Diio Mi shows that out of the five new routes, Wizz Air has currently scheduled flights on two: Marrakesh Menara Airport (RAK) and Lamezia Terme International Airport (SUF).

On BUD-RAK flights, Wizz Air will offer one more weekly frequency in July, for example, while on BUD-SUF, Ryanair will have the advantage in weekly departures.

However, Ryanair warned that the Hungarian government’s decision to slash taxes, which has fueled the airline’s growth at the airport, could be undermined by BUD’s “successive unjustified charge increases,” which have risen by 10% since 2024.

“Ryanair calls on the Hungarian Government as the majority owner of Budapest Airport to replicate its pro‑growth aviation policies at the Airport by immediately reducing airport charges.”

If it does, Ryanair will base five additional aircraft at BUD, increasing its annual seat capacity to more than 10 million. Currently, the airline has scheduled just over 5.8 million seats from/to BUD in 2026.

Poking at Wizz Air

Since the collapse of Malév Hungarian Airlines in 2012, Wizz Air, which is based in Budapest, Hungary, has been the largest airline at BUD, with a few exceptions. Following the pandemic, in 2022 and 2023, Ryanair actually offered more total departing seats from the airport, temporarily unseating Wizz Air from its – metaphorical – throne at the airport.

By 2024, the rankings flipped, and Wizz Air has continued to grow at BUD. During the first 10 months of 2026, the airline’s scheduled flights and seats will increase by 12.3% and 12.4%, while Ryanair’s will grow by 2.6% and 2.9%.

(Ryanair has not filed its full schedule beyond October.)

Per Cirium’s Diio Mi, Wizz Air will have a 37% market share in terms of total scheduled seats at BUD during the first 10 months of 2026, while Ryanair’s will be 26%. The numbers include the five new routes mentioned above.

In July, for example, while the low-cost carrier will add a total of six routes that it had not operated in July 2025 – the aforementioned five plus BUD-Amman Queen Alia International Airport (AMM) – it removed five other itineraries and cut flights on another four.

The quintet of destinations that it flew from BUD in July 2025 but no longer plans to fly during the same month in 2026 includes Belfast International Airport (BFS), Faro International Airport (FAO), Frankfurt Hahn Airport (HHN), Lanzarote Airport (ACE), and Trieste Airport (TRS).

None of the airports is currently served by Wizz Air.