Ryanair and Wizz Air vie for the top spot at Tirana International Airport

Wizz Air, which is currently the dominant airline at Tirana International Airport, is being challenged by Ryanair.

Ryanair and Wizz Air have both been adding additional capacity at Tirana International Airport (TIA). The two low-cost carriers recently announced expansion plans at the airport, including last week’s announcement from Ryanair that it will base a fourth Boeing 737-800 at TIA and add 20 new routes during the summer 2026 season.

On January 20, 2026, Ryanair praised the Albanian government and TIA for their “proactive” approach to reducing access costs in the country and at the airport, promising to grow its traffic by 50% in 2026.

As a result, the Irish low-cost carrier will base its fourth 737-800 at the airport from April, opening 20 new routes from TIA and taking its route total from the airport to 43. According to its own estimates, this should result in it carrying around 4 million passengers per year from the Albanian capital.

In the near term, Ryanair is planning to base up to six additional 737-800s at TIA, offering its customers up to 60 routes, which will result in annual passenger numbers of 6 million at TIA.

However, the airline said that the long-term growth plans will become a reality only if the Albanian government “continues its zero aviation tax policy, and [TIA] maintains its low access costs via growth incentive schemes, to stimulate rapid traffic and tourism growth in Tirana.”

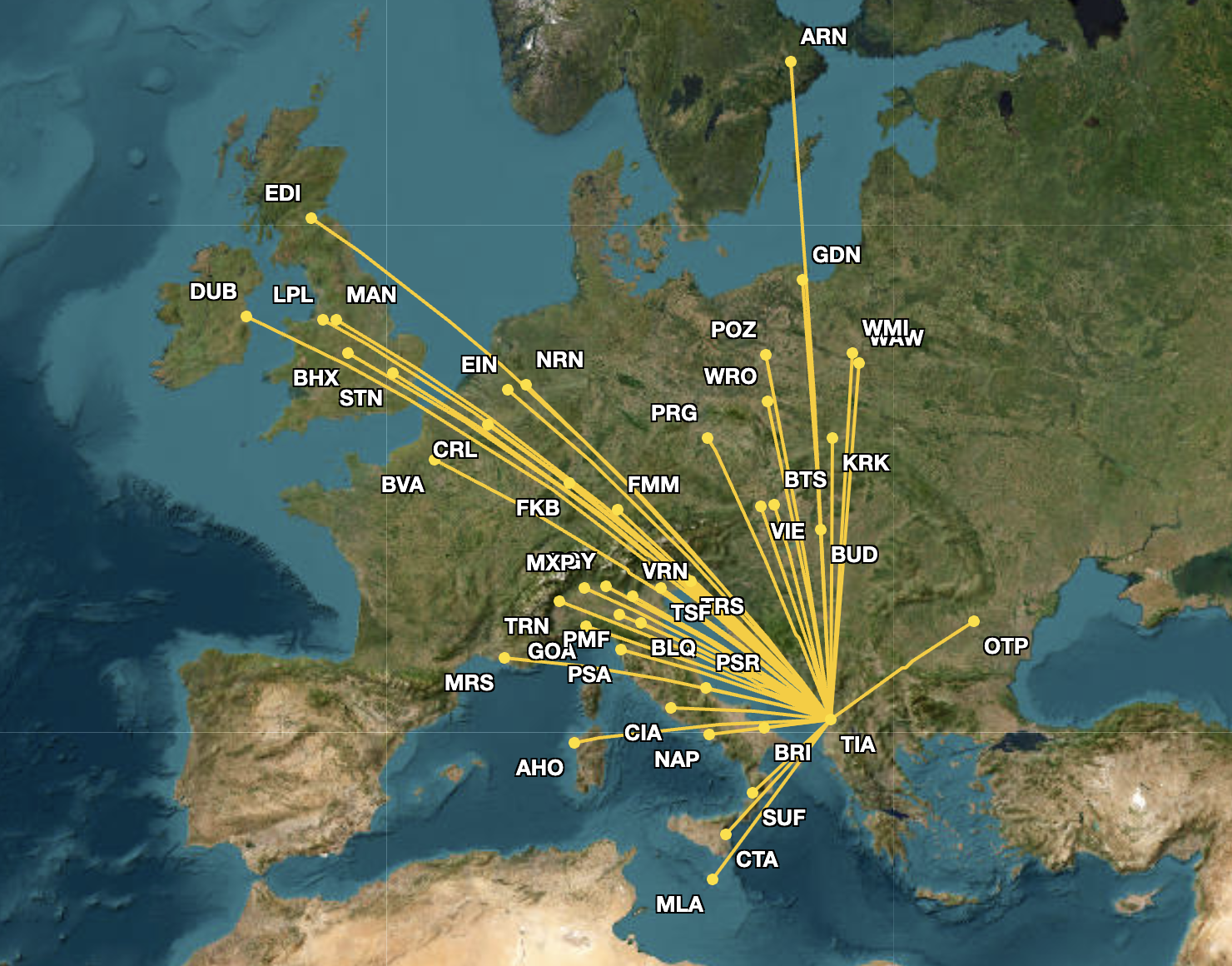

Ryanair’s planned network at TIA

Currently filed schedules on Cirium’s Diio Mi indicate that in July 2026, Ryanair plans to operate 268 weekly departures from TIA, offering up to 50,793 weekly seats to 43 destinations.

Compared to July 2025, the low-cost carrier will offer around 65% more weekly flights and seats.

Ryanair’s July route network from TIA is displayed below.

New destinations for 2026 include Dublin Airport (DUB), Milan Malpensa Airport (MXP), Memmingen Airport (FMM), and others.

Overall, Ryanair will operate 13 new routes in July 2026 compared to the year prior, of which nine routes are to Italy, where there is a large Albanian diaspora. According to data from the Italian National Institute of Statistics (Istituto nazionale di statistica, Istat), there were over 400,000 Albanians resident in Italy as of 2024.

In July, out of Ryanair’s 147 weekly departures from TIA, around half, 89, will connect the Albanian capital with Italian cities, including 24 weekly flights to Milan Bergamo Airport (BGY), Cirium’s Diio Mi showed.

Catching up to Wizz Air

Prior to Ryanair unveiling its expansion at TIA, in December 2025, Wizz Air announced that it would launch four new routes from the airport, allocating its 15th aircraft to the Albanian capital during the summer 2026 peak season.

“In total, Wizz Air will offer 5.6 million two-way seats for the Summer 2026 season, supported by operations with 15 aircraft based in Tirana during the summer peak.”

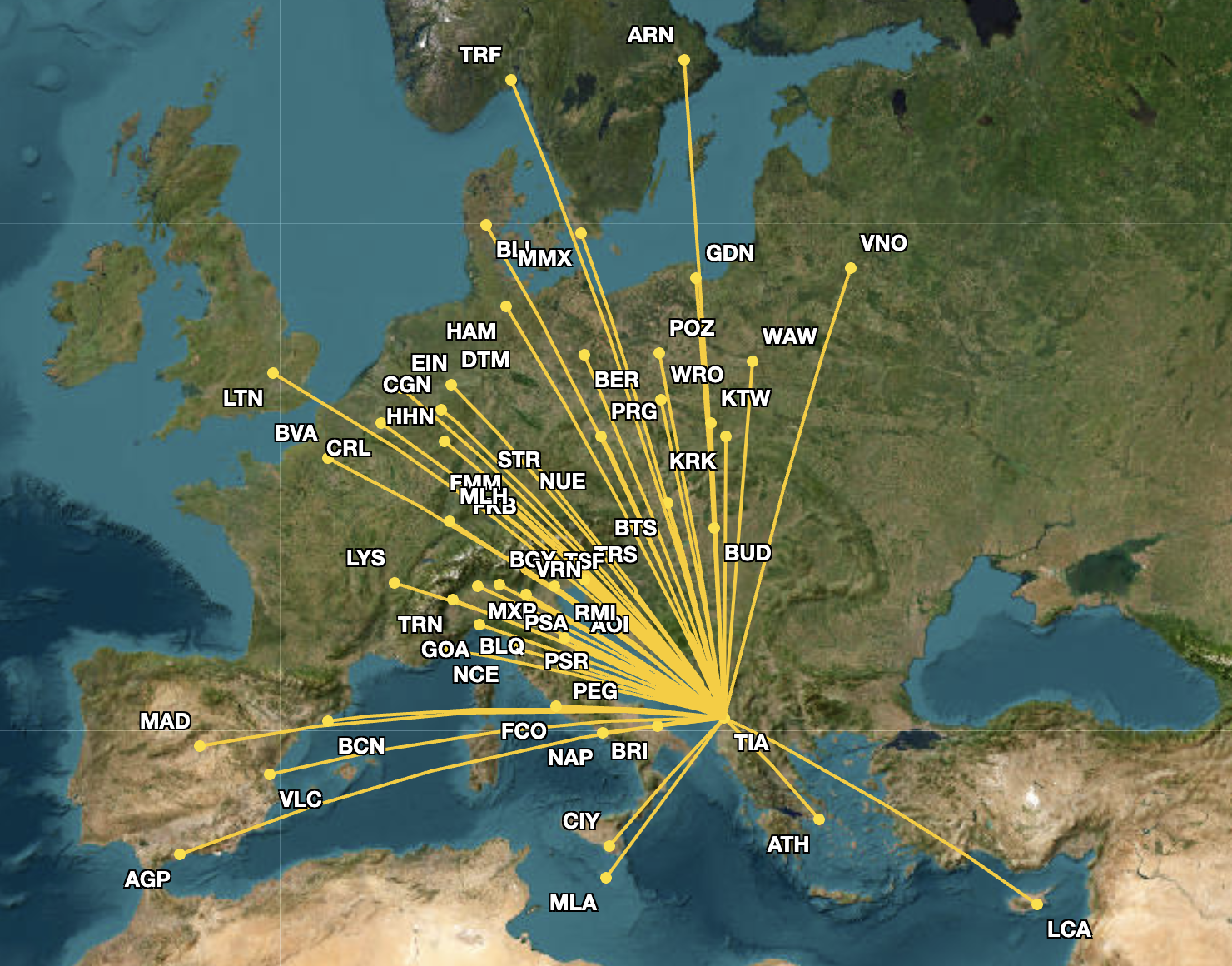

In comparison to Ryanair’s 240 weekly departures from TIA, Wizz Air will offer 350 weekly departures and 81,280 weekly departing seats, Cirium’s Diio Mi showed. To Milan, which includes BGY and MXP, it scheduled 35 weekly departures, or five per day, during the month.

Similar to Ryanair, Wizz Air’s main focus from TIA is Italy, with 157 weekly departures between the two countries, and 36,086 weekly departing seats scheduled for July 2026.

Wizz Air’s network from TIA in July is displayed below.

Wizz Air’s overall weekly departures and seats from TIA will grow by 6.4% and 6.2% year-on-year (YoY), respectively.

Low-cost duel at TIA

Despite its lower capacity growth in 2026, Wizz Air will firmly retain its lead in TIA with a 44% share of departing seats in July 2026.

Ryanair comes in second with a 27% market share. Third place goes to the Lufthansa Group, which will collectively operate 7% of seats at TIA during the month, per Cirium's Diio Mi.

Wizz Air has been the market leader at TIA for several years after opening its base in 2020. Wizz Air’s market share peaked in 2023 with 54% of seats, according to Cirium’s Diio Mi.

However, that was before Ryanair entered the airport.

By July 2024, the Irish low-cost carrier had established a substantial presence at TIA, having entered the Albanian capital in October 2023 with an initial 17 routes during that winter season.

However, that only put a small dent in Wizz Air’s market share, which continued to hover at around 50% (49.1%) in July 2024. By July 2025, the low-cost carriers’ market share split was 19.6% (Ryanair) to 48.7% (Wizz Air), with both airlines losing market share as more airlines have launched services from/to TIA.

The Irish carrier’s growth at the airport has not gone unnoticed. While Wizz Air is yet to formally respond with more routes and/or seats from TIA, the airline did issue a statement that emphasized its presence at the airport since 2017.

“In 2025 alone, our teams operated nearly 31,000 flights [from TIA], carried 6.5 million passengers, and delivered a 99.83% completion rate, one of the strongest in the industry.”

Wizz Air, citing “our continued investment in Albania,” launched a limited-time promotion, offering 10% discounts on 500,000 seats from/to TIA for travel until October 31.

“Tirana, Let’s WIZZ!”

One of the fastest-growing airports in Europe

Since the pandemic, TIA has been one of the fastest-growing airports in Europe. According to Cirium’s Diio Mi, seat capacity at TIA grew by 115% from 2019 to 2025.

Between 2019 and 2024, annual passenger traffic at TIA increased from 3.3 million to 10.7 million, leapfrogging other leading airports in the region like Sofia International Airport (SOF) and Belgrade Nikola Tesla Airport (BEG). In 2025, airlines scheduled 13.1 million seats from/to TIA, growing to 15.2 million seats in 2026.

A major turning point for TIA was in December 2020, when Kastrati Group, an Albanian conglomerate, purchased the airport for €71 million ($84.3 million). A month later, TIA announced that it was reducing its per-passenger charge of €12.5 ($14.85) to €10 ($11.88), and an investment of up to €100 million ($118.7 million) into “expanding the airport's accommodation capacity by 6 million passengers per year, runway extension, complete improvement of airport infrastructure, and significant improvement of service quality.”

Comments ()