The United States Bankruptcy Court for the Southern District of New York has approved Spirit Airlines’ sale of two out of four preferential use gates at Chicago O’Hare International Airport (ORD) to American Airlines. Spirit Airlines will use the deal’s proceeds to pre-pay its debtor-in-possession (DIP) loans.

In a motion on December 15, 2025, the court overseeing Spirit Airlines’ Chapter 11 bankruptcy process, having observed “non-collusive, in good faith, at arm’s length, and substantively and procedurally fair” negotiations, approved Spirit Airlines’ motion to sell two out of four preferential use gates to American Airlines at ORD.

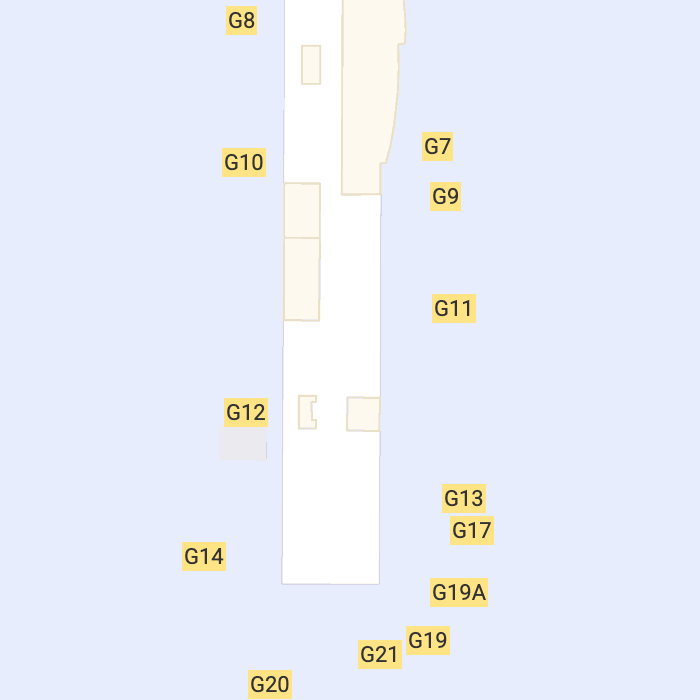

The pair of gates, G8 and G10, located at Terminal 3 at ORD, were sold for $30 million, the court filing showed. Spirit Airlines, which has leased four gates at ORD, including G12 and G14, will retain the latter two.

According to the filing, the effective date of the sale will be the first business day when three conditions will be met: first, both airlines have executed their commitments; second, the transaction has been approved by the court; and third, it has not been terminated by the low-cost carrier before that date.

“[…] as of the Effective Date, (a) [Spirit Airlines] hereby assigns, conveys, transfers and sets over unto [American Airlines] all of [Spirit Airlines’] right, title and interest in, to and under the Lease with respect to the [sold gates], but such assignment is effective only with respect to the [sold gates] and nothing herein shall be deemed to constitute an assignment of the Lease, or any rights or obligations thereunder, to [American Airlines] with respect to the [retained gates G12 and G14] and (b) [Spirit Airlines] shall have no further right, title or interest in, to or under the [sold gates] or the Lease with respect to the [sold gates].”

In the initial motion filing, which Spirit Airlines’ counsel handed over to the court on November 17, they argued that while the low-cost carrier has been leasing the gates since entering into an Airline Use and Lease Agreement (AULA) with the City of Chicago in 2018, it had around 32 peak daily departures from ORD.

“That number has now been halved, so in the [airline’s] reasonable business judgment, having access to half of its preferential gates at O’Hare would meet Spirit’s needs,” they said. Furthermore, under the DIP agreement, which granted the carrier $475 million of additional liquidity in several tranches, with specific conditions being attached to access those cash reserves, the airline “must use commercially reasonable efforts to dispose of certain assets, including all non-core gate leaseholds.”

Spirit Airlines’ counsel also argued that since preferential gates are assigned to airlines already operating from/to ORD, the market for these gates is “strictly limited to just a few airlines who already operate at O’Hare, who can take on additional capacity at O’Hare, and who can operate out of the terminal where the [gates] are located.”

“Moreover, the price of $15 million per gate, which is the product of lengthy, good-faith, arm’s-length negotiations between Spirit and American Airlines, is reasonable based on current market conditions.”

American Airlines also has an Admirals Club “across from gate G8,” according to the airline’s website, with the airport’s site showing that the carrier operates all of its departures from Terminal 3, where the concourse housing the gates is located.

Spirit Airlines will use the $30 million to pre-pay its DIP loans. The airline, which seemingly got close to ceasing operations during the weekend, was granted a lifeline by its noteholders on December 15, approving an amendment to the carrier’s DIP agreement, providing an immediate $50 million liquidity boost to Spirit Airlines.

The remaining $50 million would become available to the airline once it fulfills specific conditions, including progress on a standalone post-bankruptcy plan or “a strategic transaction.”

Per Cirium’s Diio Mi, between January 2018 and December 2025, Spirit Airlines’ one-way departures from ORD had peaked in August 2024, when it had 212 weekly departures, or up to 31 per day.

In 2025, the low-cost carrier had no more than 23 daily departures from ORD, which happened in May, when it scheduled 23 departing flights on Mondays and Fridays. During the same month, the only airline had 14 departures on Tuesdays, 12 on Wednesdays, and 15 on Saturdays.

For American Airlines, the acquisition will mark an important step in regaining ground at ORD, especially versus United Airlines. During its latest annual reallocation process, which was spurred by United Airlines, the City of Chicago’s Department of Aviation took away four gates from American Airlines and granted United Airlines five gates.

While this had resulted in a lawsuit filed by American Airlines, it did not yield anything for the airline, and it eventually withdrew its lawsuit on July 16.

The gate redistribution went into effect on October 1.

Still, despite the legal setback, American Airlines has been determined to keep fighting United Airlines at ORD. During the carrier’s Q3 earnings call, Robert Isom, the Chief Executive Officer (CEO) of American Airlines, said that the airline anticipated that ORD “will return to its rightful place as one of our largest and more [sic] profitable hubs.

“So, capacity, at least in Chicago, as we take a look at [it], we are going to fly what we can. It will again be over 500 departures capacity throughout the system.”

Later during the call, Isom reiterated that ORD can support two hub carriers, adding that the airport will become the carrier’s third-largest hub. “There are not many 500 departure hubs out there,” Isom continued, concluding that the level of capacity was “critically important” to its customers at ORD and those who connect in the region, ensuring that there is enough “competitive service.”