Sun Country Airlines, which recently signed a merger agreement with Allegiant Air, has reported its Q4 2025 and full-year results, ending the year with slightly lower profit as it shifted more capacity to fly charter and cargo operations during the quarter.

Positive net margin but down vs 2024

Sun Country Airlines ended the quarter and the year with a net profit of $8.1 million and $52.8 million (non-adjusted), which was a decrease of 39.4% and 0.2% year-on-year (YoY), respectively. The airline’s quarterly and yearly net margins were 2.9% and 4.6%, down from 5.1% and 4.9% in 2024.

In Q4 2025, cost inflation outpaced revenue growth, with the airline ending the three-month period with total operating revenues of $280.9 million and expenses of $262.7 million, resulting in an operating income of $18.1 million, 30.3% lower YoY.

Yearly revenues of $1.1 billion were higher than its operating costs of $1 billion, yet much like during the quarter, expenses grew faster than Sun Country Airlines’ revenues.

Shifting flying to cargo and charter

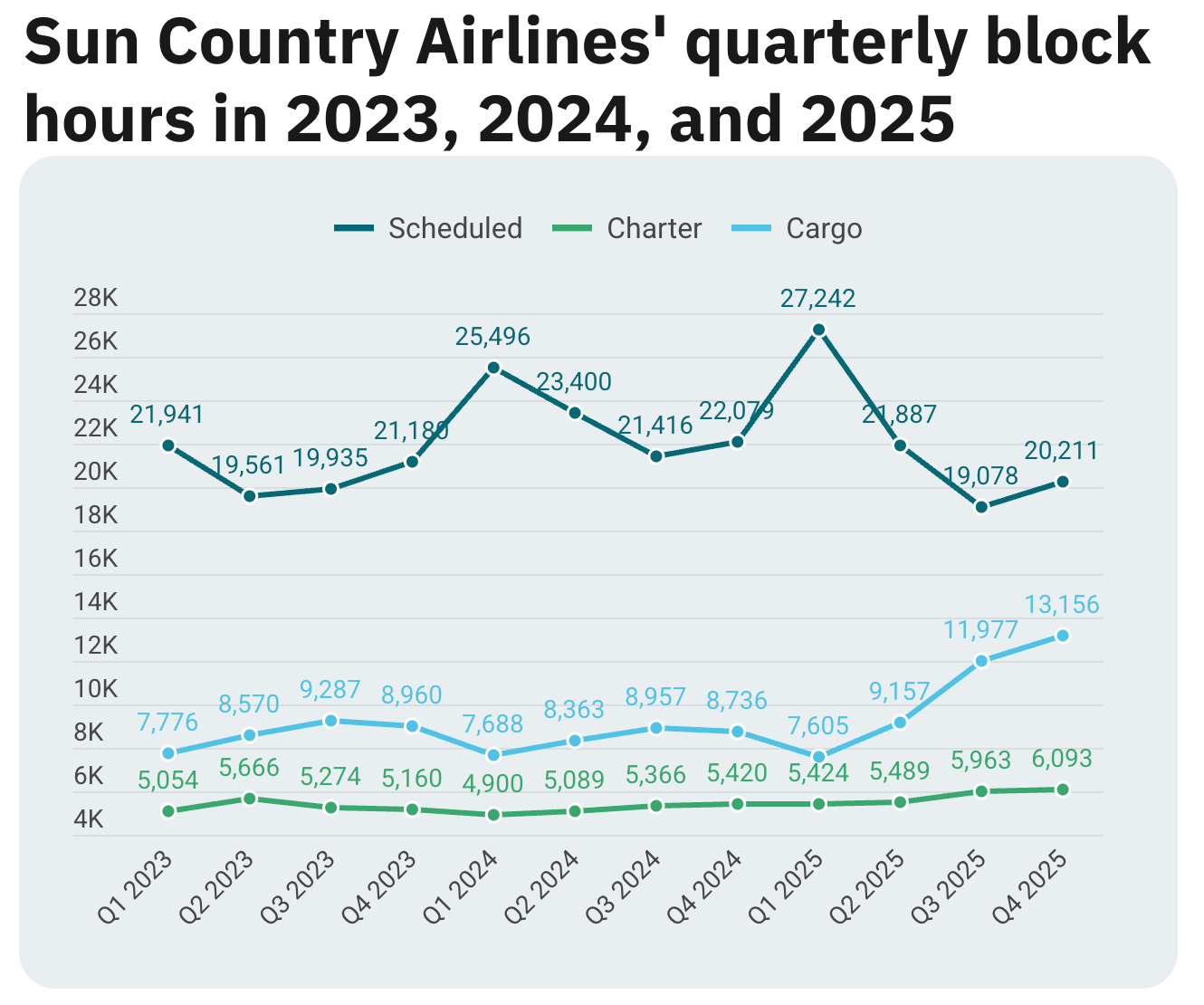

During the past three years, Sun Country Airlines has gradually operated more cargo and charter flights, its quarterly filings show. While the growth in charter block hours (BHs) has been more gradual, cargo BHs grew in the high double digits during the latter part of 2025.

At the same time, scheduled flights’ BHs are slowly trending downward, and following steady growth in 2024, are now comparable to 2023 levels, with the exception of a spike in Q1 2025.

Overall system capacity, measured in available seat miles (ASMs), which includes passenger, charter, and cargo flights, was down 5.8% YoY in Q4 2025 and down 1.8% YoY for the full year.

According to planespotters.net, in 2025, Sun Country Airlines welcomed 11 aircraft in 2025. Eight of those aircraft were converted Boeing 737-800 freighters, flying on behalf of Amazon Air. Jude Bricker, the President and Chief Executive Officer (CEO) of Sun Country Airlines, said that the addition of the eight cargo aircraft mandated “deliberate capacity adjustments in our scheduled service network, and despite this complexity, we delivered margins that are among the highest in the industry.”

In 2026, the carrier is not only launching a new operational base at Cincinnati/Northern Kentucky International Airport (CVG), but is also planning the addition of at least four aircraft, two of them freighters, one of which will be an operational spare. The pair of converted freighters is expected to be operational in Q3 2026, resulting in Sun Country’s cargo fleet increasing to 22 aircraft in 2026 – almost double the 12 freighters in the airline’s fleet at the end of 2024.

The two passenger 737-800 and 737-900ER aircraft, delivered in Q4 2025, are currently being reconfigured to match the airline’s cabins, it said. The third passenger aircraft that the airline welcomed in 2025, a 737-900ER, registered as N904SY, entered service in September 2025.

Strong unit revenue performance across all business units

All three of Sun Country’s business units saw strong unit revenue performance in Q4 2025. Total revenue per ASM (TRASM) on scheduled services increased by 8.9% YoY on the back of a 9.8% reduction in ASMs and “a strong demand environment.”

Charter revenue grew by 18% YoY on 11.4% more ASMs, while cargo revenue grew by 68% on 51% capacity growth. Charter and cargo revenue comprised 20% and 17% of the company’s total revenue, respectively.

Torque Zubeck, the Chief Financial Officer (CFO) of Sun Country Airlines, said that the airline ended the quarter with “record cargo revenue and the highest fourth quarter charter revenue in company history.”

“We are well-positioned for continued growth in 2026 as first quarter demand trends remain strong, and we will be growing back our scheduled service business later in the year.”