How has the transatlantic narrowbody market evolved since 2019?

The Boeing 757 has been dethroned as the king of narrowbody transatlantic flying.

During the summer of 2019, the northern transatlantic narrowbody market was a relatively niche segment largely dominated by the Boeing 757. Following a series of recent route announcements in the market from the likes of Air Canada, Iberia, JetBlue, and WestJet, The Engine Cowl takes a look at how the market has changed since 2019.

According to Garth Lund, the Founder and Managing Director of Alpcor Aviation, “narrowbody service across the northern Atlantic has grown considerably in recent years and looks set to continue unabated, particularly as more A321XLRs come online.” This should benefit regional airports and their customers on both sides of the Atlantic, Lund added.

How much has the narrowbody market grown since 2019?

Overall, the northern transatlantic market between the US and Canada and Europe has grown well beyond 2019 levels. According to Cirium’s Diio Mi, the number of flights scheduled in June-August 2026 between the US/Canada and Europe is scheduled to be almost 17% higher than during the same period in 2019, while the number of seats is planned to be 12% higher.

While that is impressive growth on an already large market, it pales in comparison to the growth of the narrowbody segment within the northern transatlantic market, which has seen the number of flights operated by narrowbodies grow by over 120% between summer 2019 and summer 2026.

As a result of this impressive growth, the narrowbody share of departures on the transatlantic market has grown from 8.5% in summer 2019 to just over 16% in 2026.

How has fleet composition changed in the narrowbody market?

The growth in the narrowbody transatlantic market has been powered by the delivery of new-generation aircraft, namely the A321LR, A321XLR, and the 737 MAX. While in summer 2019, the 757 accounted for 82.3% of the narrowbody segment, in 2026, only 14.9% of departing seat capacity is scheduled to be flown on the type.

United Airlines is the predominant operator of the type and has even slightly increased its scheduled 757 transatlantic capacity in summer 2026, compared to summer 2019, by 165 additional one-way departures.

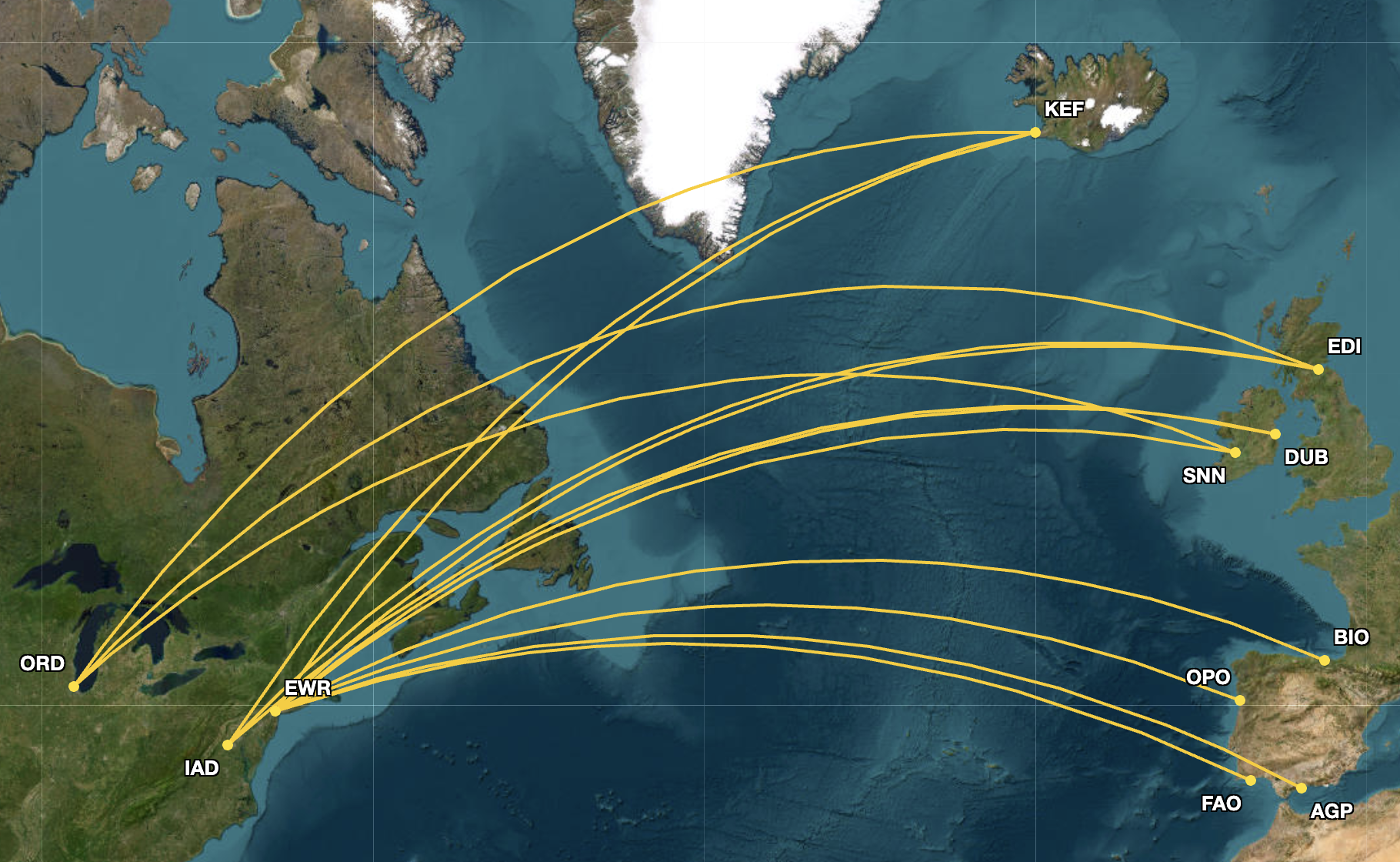

The carrier’s 757 routes during the summer of 2026 are displayed below:

Instead, the 737 MAX now accounts for 25% of the market, while the A321neo and its derivatives, the A321LR and A321XLR, account for 56.7%. The first transatlantic 737 MAX route was operated by Norwegian between Edinburgh Airport (EDI) and Bradley International Airport (BDL) in July 2017, while TAP Air Portugal was the first airline to deploy the A321LR with its Porto Airport (OPO) to Newark Liberty International Airport (EWR) route on June 1, 2019.

Which airlines are operating narrowbodies on the transatlantic market?

In summer 2019, 13 airlines operated narrowbodies across the northern Atlantic. In 2026, the count is scheduled to grow to 15, per Cirium’s Diio Mi.

While in 2019, the narrowbody market was dominated by Icelandair and United Airlines, with both having offered more than 200,000 departing seats on single-aisles, in 2026, Air Transat, Aer Lingus, and JetBlue are all now significant operators as well.

Notably, British Airways has exited the narrowbody segment following the cancellation of its one-stop A318 service between London City Airport (LCY) and New York John F. Kennedy International Airport (JFK) via Shannon Airport (SNN) in March 2020.

Norwegian was also another operator to stop flying narrowbodies across the Atlantic Ocean, with the low-cost carrier ending all of its transatlantic operations – with twin and single-aisle jets – during the pandemic, focusing on short-haul European flights following its restructuring.

Out of the 15 airlines flying narrowbodies across the Atlantic in 2026, only two, American Airlines and Delta Air Lines, have now scheduled fewer single-aisle flights in 2026 and in 2019. For the former, this should change as it takes delivery of more A321XLRs.

For the latter, this is part of its strategy of deliberately not using narrowbodies on transatlantic routes.

Has the growth of the narrowbody market unlocked new unserved routes?

The introduction of the A321LR and A321XLR in particular has fuelled speculation that the long-range narrowbody aircraft would enable the launch of new, unserved airport pairs that would never have been economically viable to operate with a widebody.

Has growth in the narrowbody segment really driven the opening of unserved routes?

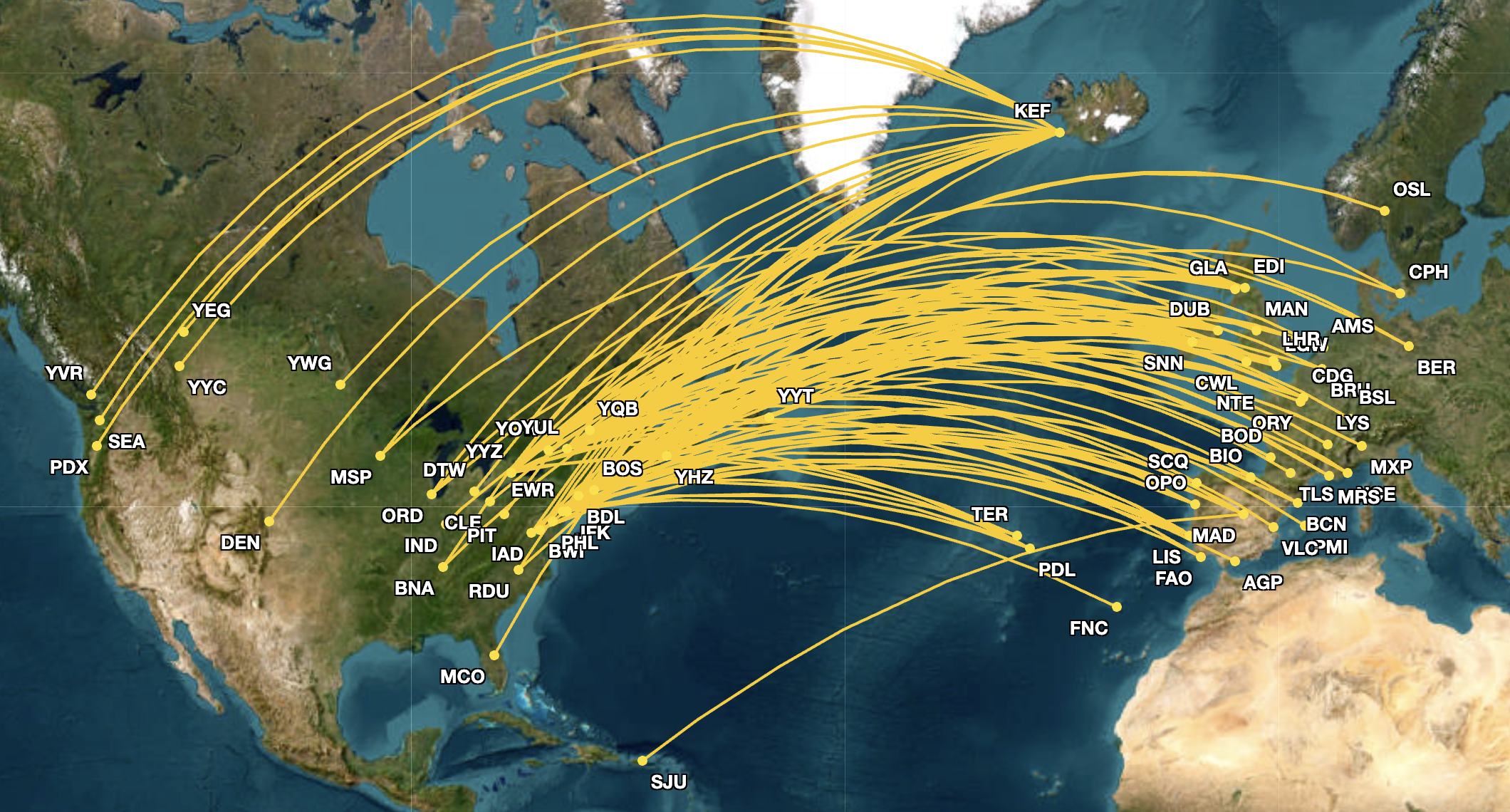

Per Cirium Diio Mi, narrowbody aircraft are currently scheduled to operate on 127 routes between Canada and the US and Europe in summer 2026.

Of these routes, 36 were unserved in 2019. However, the large majority of them, 22, are from/to Canadian airports, mostly enabled by Air Transat and WestJet’s new connections from secondary Canadian cities, such as Halifax Stanfield International Airport (YHZ), or to secondary European cities, such as Valencia Airport (VLC).

For example, WestJet has re-established YHZ as a major airport for its transatlantic operations, especially during the upcoming summer season. In summer 2026, WestJet plans nine European routes from YHZ, compared to six in 2025 and four in 2019.

Like in 2019, and in 2025, WestJet’s YHZ routes to Europe will be flown with 737s, the difference being that during the latter two years, the itineraries will be operated with 737 MAXs, which were still grounded in summer 2019.

Air Transat, meanwhile, has also expanded Canadian airports’ networks with narrowbodies, specifically, the A321LR. In 2019, the carrier had seven routes to European cities with the type, expanding its network to 28 single-aisle destinations in summer 2026. Four of those had no service in 2019.

Air Canada, which should take delivery of its first A321XLR in Q1 2026, is also adding routes that were not served in 2019. This includes flights from Montréal-Pierre Elliott Trudeau International Airport (YUL) to Berlin Brandenburg Airport (BER), Edinburgh Airport (EDI), and Palma de Mallorca Airport (PMI).

No airline flew from YUL to Berlin's international airport at the time, Tegel (TXL), in 2019.

Still, there are plenty of new US-bound transatlantic routes that have been enabled by long-range narrowbodies. Aer Lingus, which began taking deliveries of A321LRs in July 2019 and A321XLRs in December 2024, opened three new narrowbody connections to the US from Dublin Airport (DUB) last summer.

Cirium’s Diio Mi, compiling Department of Transportation (DOT) data, showed on those routes, namely to Indianapolis International Airport (IND), Nashville International Airport (BNA), and Minneapolis-Saint Paul International Airport (MSP), that Aer Lingus averaged a load factor of 78.2%. Per airport, the cabin occupancy rates were 78.3% (IND), 82.71% (BNA), and 75.4% (MSP).

DUB-MSP is perhaps the best example of downgauging helping an airline maintain a route. In summer 2024, when the Irish carrier still used an A330-200 to fly between DUB and MSP, its average load factors were 73.6%. In summer 2025, when it had already switched to the A321XLR, its load factors improved to the aforementioned 75.42%, yet on an aircraft that is much cheaper to operate than the A330-200.

The Irish carrier will expand its transatlantic narrowbody network to include Raleigh-Durham International Airport (RDU) and Pittsburgh International Airport (PIT), launching in April 2026 and May 2026, respectively. Neither RDU nor PIT had direct services to DUB in the past 15 years, Cirium’s Diio Mi showed. The DUB-PIT connection is not displayed in the map above.

Icelandair, which operates from Reykjavik Keflavik International Airport (KEF), has also said that it will accelerate the phase out of its aging 767-300ERs, retiring them by the end of 2026.

Instead, the airline will focus on A321LR, A321XLR, and 737 MAXs to operate flights to Canada and the US.

Has narrowbody growth in the northern transatlantic market been a revolution or evolution?

Overall, the narrowbody segment has seen impressive growth and opened up a number of new markets, while the reaction from airlines has been positive. Nicholas Cadbury, the Chief Financial Officer (CFO) of International Airlines Group (IAG), parent company of two A321XLR operators, Aer Lingus and Iberia, praised the single-aisle jet, describing the deployment of the A321XLR as “very successful” during the group’s Q1 earnings call.

Not everyone is convinced, though. As mentioned before, Delta Air Lines made the conscious choice of not doing so. During the airline’s Q3 earnings call, Glen Hauenstein, the President of Delta Air Lines, said that while the carrier has the “best-in-class” offering in the transatlantic market, it has chosen not to fly narrowbodies to destinations on the other side of the Atlantic Ocean due to “product and brand issues.”

Delta Air Lines’ only two transatlantic routes do not really cross the Atlantic Ocean, and instead, connect Detroit Metropolitan Wayne County Airport (DTW) and MSP with KEF.

Nevertheless, the narrowbody segment looks set to continue growing. While we have not yet seen widebodies lose their prominence in the transatlantic market, it seems likely that the narrowbody segment will continue to gain market share in the coming years.

This post is part of a sponsored campaign for Alpcor Aviation. You can reach out to us for sponsorship opportunities at rytis@enginecowl.com.

Comments ()