United Airlines has announced additional daily flights on a dozen existing routes, new connections, and growing capacity on six routes, as it says it is providing Spirit Airlines’ customers with more options if the airline goes out of business.

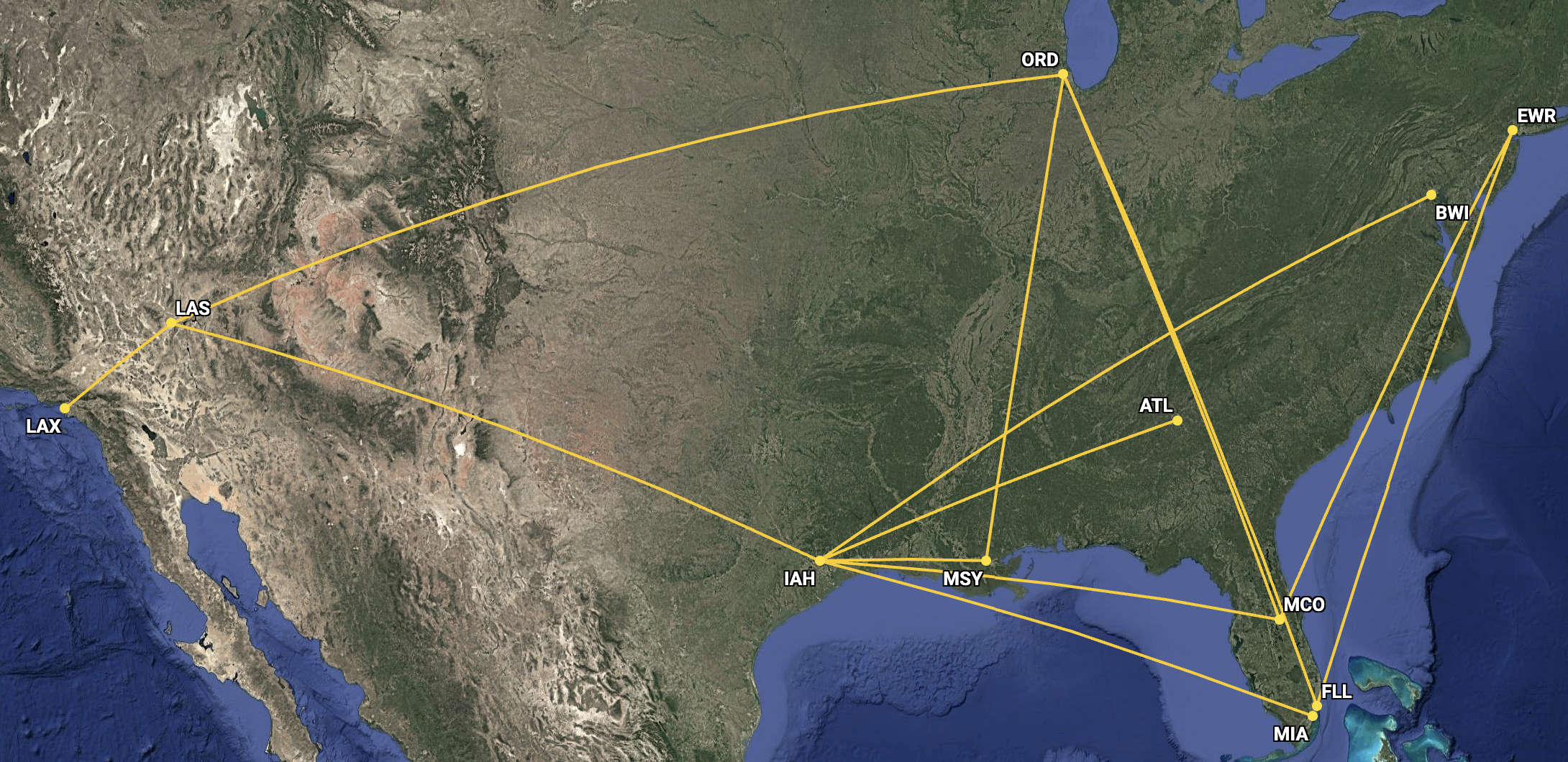

On September 4, 2025, United Airlines revealed that starting January 6, 2025, it will be adding a daily flight from Houston George Bush Intercontinental Airport (IAH) to Orlando International Airport (MCO), Las Vegas Harry Reid International Airport (LAS), Louis Armstrong New Orleans International Airport (MSY), Hartsfield-Jackson Atlanta International Airport (ATL), Baltimore/Washington International Airport (BWI), and Miami International Airport (MIA).

Cirium’s Diio Mi showed that out of the six routes from IAH with newly announced daily flights, Spirit Airlines flies on all six in September 2025, with up to double-daily flights – to LAS and MCO – and is planning to continue doing so in January 2026, at least according to the latest filings. These could change as soon as next week.

From Chicago O’Hare International Airport (ORD), United Airlines is adding a new daily flight to MCO, Fort Lauderdale Hollywood International Airport (FLL), MSY, and LAS, and from Newark Liberty International Airport (EWR), the carrier will add another daily flight to MCO and FLL.

Lastly, United Airlines will throw in another daily flight between Los Angeles International Airport (LAX) and LAS. All of the newly announced daily itineraries are displayed in the map below:

Per Cirium’s Diio Mi, Spirit Airlines also serves and has plans to do so in January 2026 on the aforementioned routes from ORD, EWR, and between LAX and LAS.

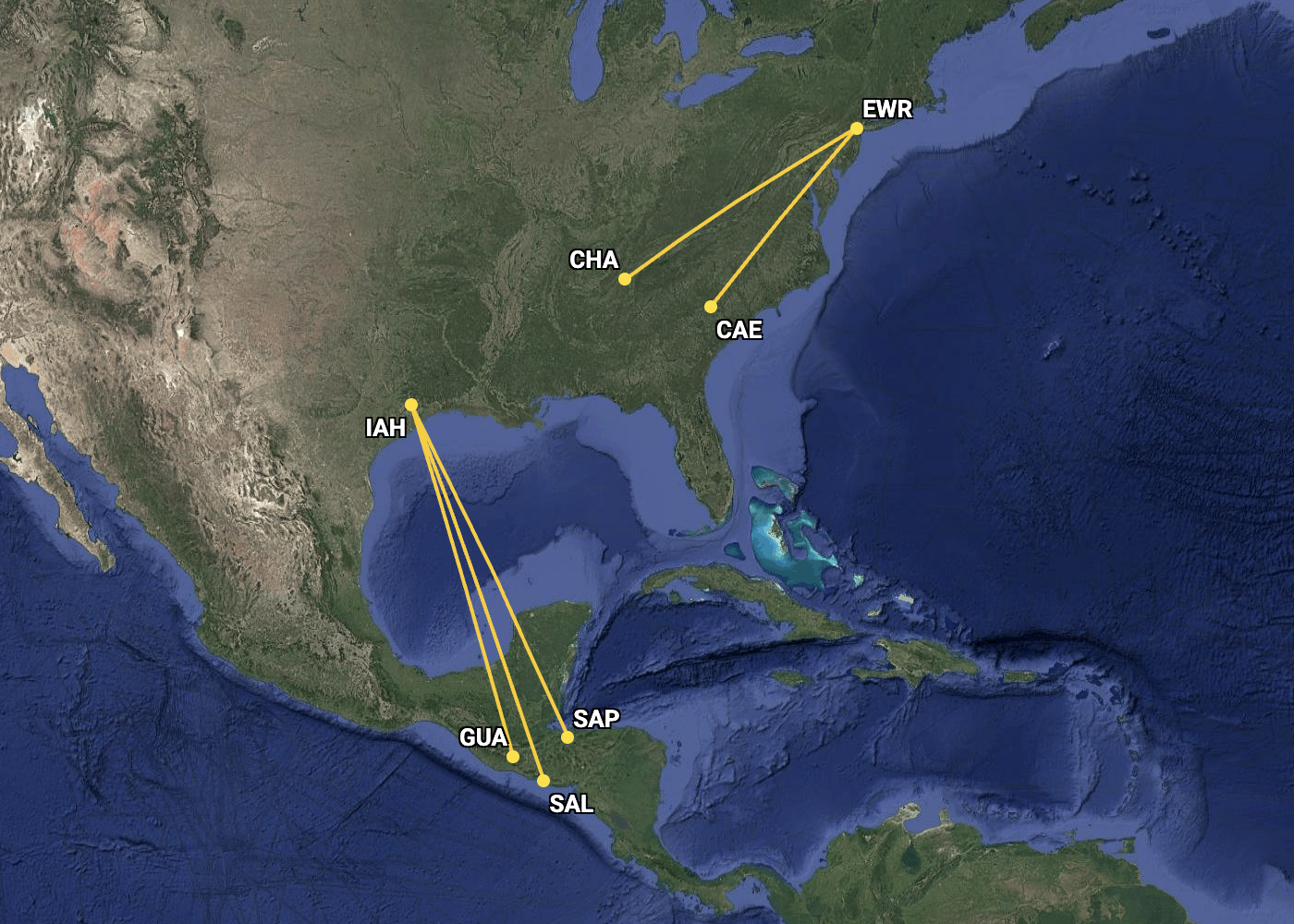

United Airlines will also add three weekly flights from IAH to Guatemala City La Aurora International Airport (GUA), El Salvador International Airport (SAL), and a weekly flight from the Texan airport to San Pedro Sula La Mesa International Airport (SAP).

Once again, Cirium’s Diio Mi showed that the ultra-low-cost carrier, operating under Chapter 11 bankruptcy protection, has planned daily flights on the three routes from IAH in January 2026.

The two new routes that United Airlines is adding are from EWR to Columbia Metropolitan Airport (CAE) and to Chattanooga Metropolitan Airport (CHA). Unlike the dozen routes shown above, where the two airlines will compete head-to-head, Spirit Airlines confirmed that it would exit both CAE and CHA from October 2, 2025.

The new routes, as well as itineraries with additional weekly departures, are displayed below:

United Airlines continued that to support its passengers flying the new routes or additional frequencies, it would schedule extra flights between IAH, ORD, and LAX, and place larger aircraft on departures between ORD and New York LaGuardia (LGA). “Tickets will go on sale later today,” it said.

Patrick Quayle, the Senior Vice President of Global Network Planning and Alliances at United Airlines, gave a very straightforward quote about the airline’s capacity changes, saying that if Spirit Airlines “suddenly goes out of business, it will be incredibly disruptive, so we're adding these flights to give their customers other options if they want or need them.”

The low-cost carrier, in less than a year, filed for its second Chapter 11 round on August 29, 2025, after having filed for the same protections on November 18, 2024, closing that case on March 12, 2025. At the time, Spirit Airlines had plans to go up-market, targeting premium leisure travelers, with Dave Davis, a former Sun Country Airlines C-level executive, taking over the reins as Spirit Airlines’ President and Chief Executive Officer (CEO) on April 21, 2025.

Unfortunately, less than six months later, AerCap, an aircraft lessor that assumed control of 36 of Spirit Airlines’ Airbus A320neo family aircraft delivery slots for the aircraft to be leased to the airline, claimed that “certain events of default under the Undelivered Aircraft Leases had occurred and were continuing and that the Lessor was terminating the Undelivered Aircraft Leases.” AerCap also informed that Spirit Airlines triggered default events on 37 aircraft that are currently with the carrier.

While the airline disagreed with the notion that it had defaulted, it filed for Chapter 11 bankruptcy protection to “position the business for long-term success.” Davis stated that since emerging from the court-protected restructuring process, “it has become clear that there is much more work to be done and many more tools are available to best position Spirit for the future.”

Spirit Airlines stated that throughout its second Chapter 11 bankruptcy case, it will “double down” on four key pillars. First, it will redesign its network to focus on flying from/to key markets to provide more destinations and frequencies in its focus cities, while cutting capacity from others. Second, it will rightsize its fleet in order to match capacity with profitable demand.

The company estimated that shedding aircraft will lower its debt and lease obligations, resulting in “hundreds of millions of dollars in annual operating savings.”

Third, Spirit Airlines will pursue further efficiencies to reduce its costs, something it had attempted to do during its first bankruptcy case, and finally, it will continue focusing on its premium travel options, namely Spirit First, Premium Economy, and Value, thus offering value at every price point to its passengers.

This is not the first time United Airlines or its executives have taken direct aim at Spirit Airlines or the low-cost carrier business model. Throughout the year or so, whether it would be appearances on The Air Show podcast, my personal favorite aviation-themed podcast!, or interviews with other news outlets, Scott Kirby, the CEO of United Airlines, has continuously ripped into no-frills airlines.

For example, talking with The Wall Street Journal in May 2025, Kirby said that the low-cost model is “dead,” adding that “their problem is that they got big enough that they needed repeat customers.”

“They don’t get them.”

Kirby explained that while many industry insiders think the business is mostly about schedules, when schedules are competitive, other things, including the passenger experience, matter.