Last week, Wizz Air announced that it will reach an important milestone in its expansion in Italy: the airline, which will base two Airbus A321neo aircraft at Palermo Airport (PMO), will hold a market share of just over 10% in the country, becoming the second-largest airline in Italy.

The achievement follows years of targeted post-pandemic growth by Wizz Air in Italy. Compared to 2019, the low-cost carrier offered almost 300% more total departing seats in 2025 and will operate over 400% more in 2026, as it seeks to build its presence in one of the most attractive leisure markets not only in Europe but also globally. The Engine Cowl explores Wizz Air’s growth in Italy and its recent base announcement at PMO.

Basing two A321neos at PMO

On February 5, 2026, Wizz Air said that it will base two A321neo aircraft at PMO, just a few months after returning to the airport. After abandoning PMO in October 2023, the low-cost carrier relaunched services from the Sicilian airport on December 16, 2025, with flights to Bratislava Airport (BTS) and Warsaw Modlin Airport (WMI).

According to Cirium’s Diio Mi, both routes challenged the incumbent Ryanair, which has a base at PMO, and by every metric, is by far the largest airline in Italy. The Irish low-cost also offers flights from PMO to BTS and WMI.

While Wizz Air has kept the same two routes, the airline stated that by basing two A321neo aircraft at PMO, it will launch six new routes, bringing its total at the airport to 10, including four domestic itineraries.

“With Palermo rejoining the WIZZ base network, Wizz Air’s operations at the airport will grow significantly. In 2026, the airline plans to offer nearly 1 million seats, with a capacity increase of more than 200% compared to today.”

Becoming Italy’s second-largest airline

Perhaps more importantly, Wizz Air pointed out that with the addition of the six new routes from PMO, its market share in Italy will grow beyond 10%, becoming the second-largest airline in Italy.

Cirium’s Diio Mi shows that in August, Wizz Air will have 337,241 departing weekly seats from Italy, helping the airline overtake ITA Airways, which currently has 322,296 weekly departing seats scheduled from its home country, including flights operated with its widebodies.

In comparison, Ryanair has over 1.1 million scheduled weekly seats, cementing it firmly at the top of the market. Another low-cost carrier, easyJet, currently has 306,982 weekly departing seats.

With a total market of over 3.3 million departing weekly seats from the country, Wizz Air’s market share will be just over 10%, enabling the low-cost carrier to claim the title of being the second-largest airline in Italy.

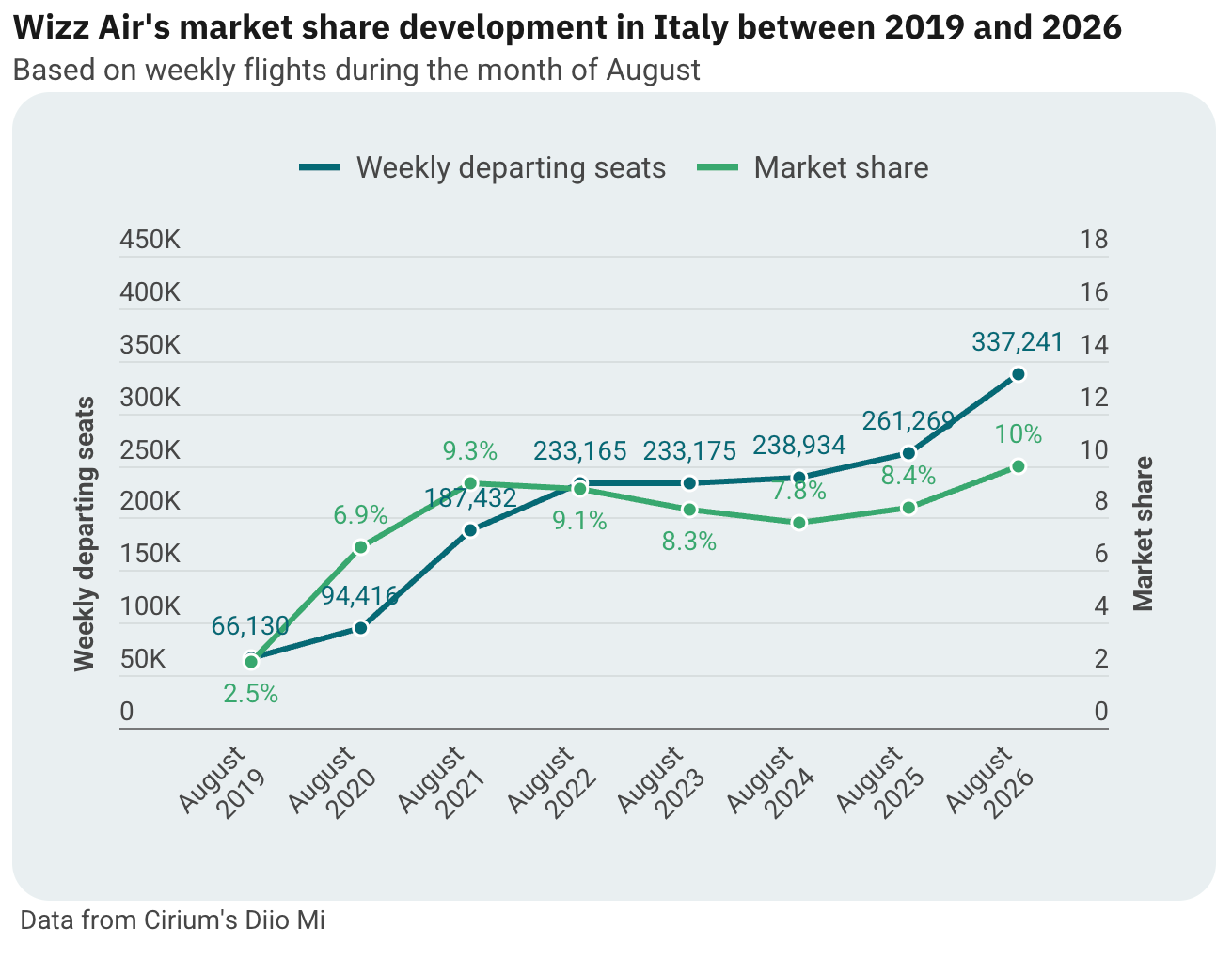

In August 2019, Italy had over 2.6 million weekly departing seats, with Wizz Air accounting for only 66,130, or 2.5% of the market.

During the next two years, the airline significantly expanded in Italy, but its growth largely stalled between 2022 and 2024. In August 2025, Wizz Air’s weekly departing seats grew by 9.3% year-on-year (YoY), and during the same month in 2026, it will grow by 29% YoY.

József Váradi, the Chief Executive Officer (CEO) of Wizz Air, said during the airline’s Q3 FY26 earnings call that in addition to refocusing on Central and Eastern Europe, stakeholders “must have noticed that we have been quite active in Italy.”

“You are now seeing new aircraft deployments in Italy,” Váradi said, teasing that there would be new developments to be announced “next week,” which turned out to be the base at PMO.

Váradi pointed out that Wizz Air recently unveiled a sponsorship agreement with AS Roma, one of the largest football – soccer – clubs in Italy, “which we think is a step up in terms of stimulating brand awareness and reputation in the market,” he added.

Comparing total departing seats in 2019 versus 2026, Cirium’s Diio Mi shows that Italy is by far Wizz Air’s biggest growth market. The low-cost carrier will add over 11 million departing seats to the country when comparing the two years.

No other country comes even remotely close to that number, with Wizz Air’s second-biggest growth market being Poland, where it will operate 5.6 million additional departing seats in 2026 compared to 2019.