Wizz Air has announced that its base at Warsaw Modlin Airport (WMI) is now online, with the airline basing two Airbus A321neo aircraft at the airport to operate 11 routes. The newest base is just the latest instance of Wizz Air directly attempting to compete with Ryanair, a low-cost giant in Europe, which has had a long presence at WMI.

On December 1, 2025, Wizz Air stated that its base at WMI is now operational. The base, comprised of two A321neo aircraft, will connect Warsaw’s secondary airport with 11 destinations, some of which have already been served by Ryanair.

“The ceremonial opening of the base took place today in conjunction with the departure of the inaugural flight from Warsaw–Modlin to Barcelona,” Wizz Air said, adding that representatives of the airline, airport, and Welcome Airport Services “took part in a symbolic ribbon-cutting ceremony inaugurating the airline’s operations at the airport.”

WMI has become the low-cost carrier’s sixth base in Poland, alongside Gdansk Lech Walesa Airport (GDN), Katowice Wojciech Korfanty Airport (KTW), Kraków John Paul II International Airport (KRK), Warsaw Chopin Airport (WAW), and Wroclaw Copernicus Airport (WRO).

Andras Szabo, the Network Officer of Wizz Air, noted that since it launched flights from the country in 2004, “Poland has been at the heart of Wizz Air’s network.” The opening of the WMI base enables the low-cost carrier to introduce 11 new routes from the airport, with the expansion reflecting Wizz Air’s “long-term commitment to the Polish market, which continues to be one of the driving forces behind our growth.”

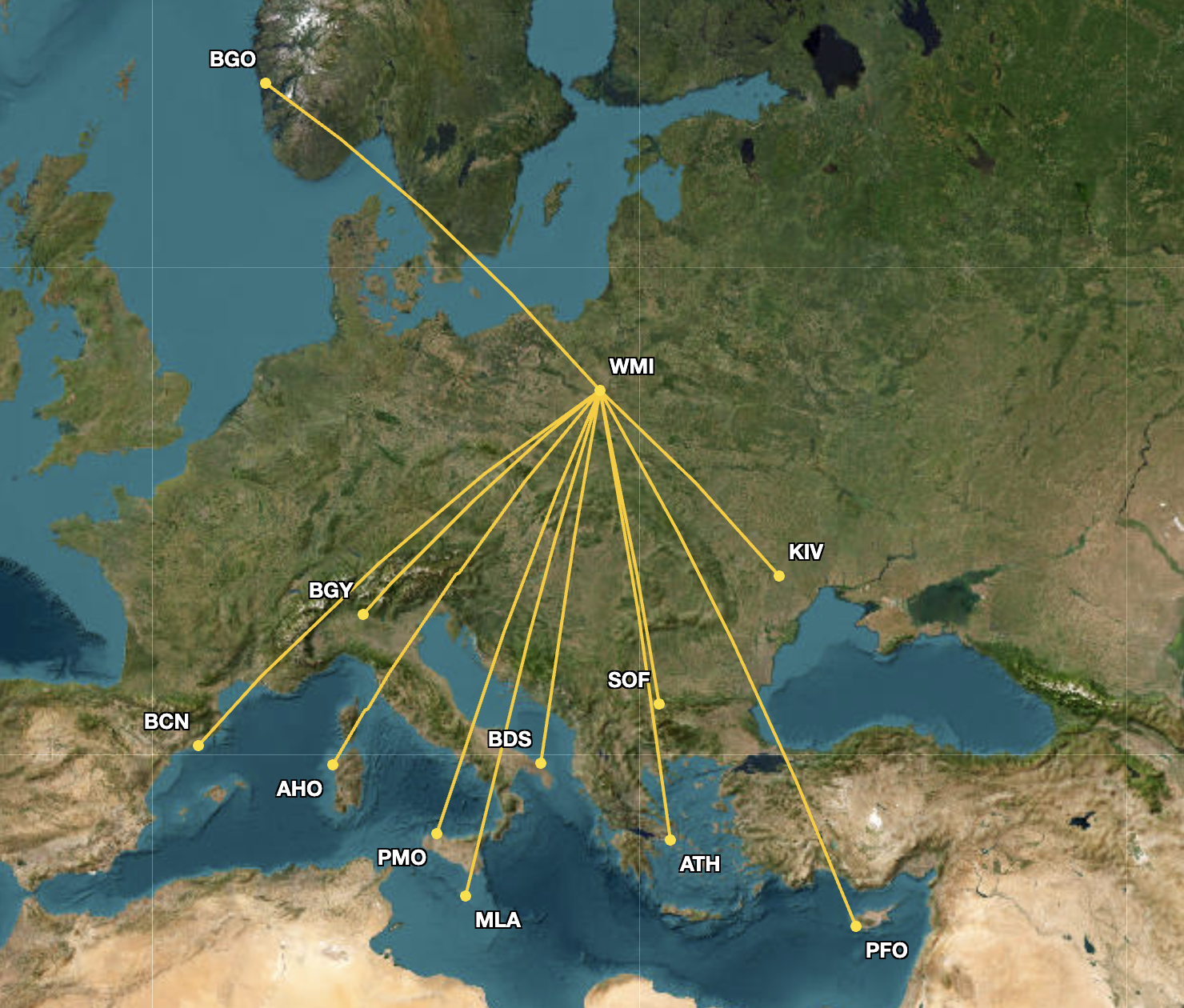

The carrier’s 11 routes from WMI are displayed below:

Flights to Alghero Airport (AHO) are beginning in March 2026, while all others are going to be online by January 2026. The map above also shows Chișinău International Airport's old designator code, KIV, and not RMO.

Do they overlap with Ryanair’s schedule? Well, per Cirium’s Diio Mi, in January 2026, both airlines will operate seven out of the 11 routes announced by Wizz Air. This includes flights to Athens Airport (ATH), Barcelona El Prat Airport (BCN), Milan Bergamo Airport (BGY), Malta Luqa International Airport (MLA), Pafos International Airport (PFO), Palermo Airport (PMO), and Sofia International Airport (SOF).

In terms of daily overlap, flights from WMI to all seven airports will see both low-cost carriers offering departures on the same day. For example, in January 2026, Ryanair and Wizz Air have scheduled two and four weekly departures to BCN, respectively. The former’s depart on Friday and Sunday, while the latter’s leave WMI on Monday, Wednesday, Friday, and Sunday.

On flights to ATH, Wizz Air’s four departures directly overlap with Ryanair’s five weekly departures, and from WMI to BGY, both will have daily flights, with the Irish low-cost carrier scheduling 11 weekly departures on the route, including two departures on Monday and Sunday, and three on Friday.

Could Ryanair back down and avoid a potentially costly battle?

In July, Ryanair and WMI signed a long-term agreement, with the Irish low-cost carrier committing to more than tripling its passenger traffic from the airport, from 1.5 million passengers per year to 5 million by 2030.

“As part of this agreement, Warsaw Modlin Airport has committed to expanding its terminal and aircraft stands to provide at least 4 new check-in desks (bringing the total to 8) and 4 new aircraft stands (bringing the total to 12) by September 2027.”

Furthermore, Ryanair plans to base four additional Boeing 737s, essentially doubling its base at the airport.

Then, there is the fact that both airlines have overlap with their own routes from WAW, Warsaw’s main airport. Wizz Air, for example, has scheduled flights to BCN, BGY, and MLA from both WAW and WMI, while Ryanair only has a single airport that it serves from both airports: PFO.

Nevertheless, before Wizz Air came barging in, in October, Ryanair held a market share of 100% weekly departing seats, per Cirium’s Diio Mi. Not a typo. In January 2026, that shifted to 65.2% (or 19,318 out of 26,618 weekly departing seats), with Wizz Air scheduling 9,028 weekly departing seats from the airport. Air Arabia will also be offering daily A321LR flights to Sharjah International Airport (SHJ).

Unlike Wizz Air, which has been dealing with aircraft groundings related to the accelerated removals and inspections of the Pratt & Whitney PW1100G engine, Ryanair has been aggressively expanding throughout the past year, and in October and November alone, it took delivery of six 737 8 MAX-200 aircraft.

Seemingly, its only capacity growth constraint has been Boeing’s ability to deliver aircraft on time. When Ryanair presented its H1 FY26 results on November 3, the Irish low-cost carrier outlined that it has a cost advantage over Wizz Air, with expenses per passenger being €35 ($40.66) versus €62 (72.01).

Ryanair’s biggest advantage versus Wizz Air is in unit costs excluding fuel, where there is a €23 ($26.71) gap, according to the former’s financial presentation. Wizz Air’s latest financial results indicated that its cost per available seat kilometer (CASK) was €0.0446 ($0.052), while Ryanair has not published its CASK figures for H1 FY26.

Ryanair’s FY25 annual report disclosed that its cost per available seat mile (ASM), not kilometer, was €0.0746 ($0.087). However, comparing miles and kilometers, and CASK and CASM, is a bit appley versus orangey.

Wizz Air also serves another airport near Warsaw, Warsaw Radom Airport (RDO). Although the airport is located over 100 kilometers (62.1 miles) from the city center, it is more akin to other low-cost carrier airports within Europe, such as Paris Beauvais Airport (BVA), which are only marketed as airports that serve those cities despite their distance from urban centers.

In an interview with money.pl in October, József Váradi, the Chief Executive Officer (CEO) of Wizz Air, said that while RDO is not a viable alternative to either WAW or WMI, “it could become one, though it will be a long process.”

“Yes, we still only have one route from Radom, but I'm open to considering one or two more to see how we proceed along this path,” he stated, adding that the low-cost carrier will have to choose which airport it wants to serve in Warsaw due to WAW’s capacity constraints.

“Ideally, we'd like to have all routes from Warsaw at one airport, but this option isn't available,” he told the Polish outlet.